Cache Coherence Protocols: MESI and MOESI Explained

TL;DR: Ethereum's 2022 transition from energy-intensive mining to validator-based staking cut energy use by 99.95%, transforming blockchain economics from hardware races to capital commitment while proving decentralized systems can execute radical architectural changes.

On September 15, 2022, at precisely 06:42:42 UTC, something extraordinary happened. Ethereum, the world's second-largest blockchain network, executed what many called the most significant upgrade in cryptocurrency history. In a span of roughly 15 minutes, the network transitioned from consuming approximately 94 terawatt-hours annually to using just 0.01 terawatt-hours. That's a 99.95% reduction in energy consumption, achieved not through gradual optimization but through a fundamental architectural transformation. The implications ripple far beyond environmental metrics, touching everything from how value is created in digital networks to who gets to participate in maintaining them.

The shift from Proof of Work (PoW) to Proof of Stake (PoS) isn't simply a software update. It represents a complete reimagining of how decentralized networks achieve consensus. Under PoW, miners competed to solve complex mathematical puzzles, with the winner earning the right to add the next block to the blockchain. This process demanded enormous computational power, with specialized mining rigs running 24/7, consuming electricity at rates comparable to small nations.

PoS eliminates this computational arms race. Instead of miners, the network relies on validators who stake their own cryptocurrency as collateral. To become an Ethereum validator, you need to lock up 32 ETH (roughly $96,000 at early 2025 prices). The network randomly selects validators to propose and attest to new blocks, with selections weighted by the amount staked. It's like replacing a stadium full of athletes competing in a sprint with a lottery system where ticket holders take turns managing the scoreboard.

The security model shifts fundamentally. In PoW, attacking the network meant controlling 51% of computational power, requiring massive hardware investment. In PoS, an attacker would need to control 51% of staked cryptocurrency. But here's the clever part: if validators behave maliciously or fail to perform their duties properly, they face "slashing," where a portion of their staked ETH is permanently destroyed. Minor infractions might cost 0.5 ETH, but coordinated attacks can result in the loss of the entire 32 ETH stake.

The technical implementation involved years of research and testing. The Beacon Chain, launched in December 2020, ran in parallel with the original Ethereum chain for nearly two years, allowing validators to join and test the system before the actual transition. When "The Merge" finally happened, over 400,000 validators were already operating, collectively securing more than 13 million ETH.

This isn't the first time humanity has witnessed a fundamental shift in how networks create and maintain value. Consider the transition from physical gold to paper currency in the 19th century. Gold standard advocates argued that removing the physical constraint would undermine trust. Sound familiar? Yet the shift to fiat currency enabled economic expansion impossible under gold's physical limitations.

Or think about the internet itself. In the 1990s, telecom giants argued that quality communication required dedicated circuit-switched networks. The packet-switched architecture of the internet seemed wasteful, sending data through unpredictable routes. Today, we conduct video calls spanning continents without a second thought.

The printing press offers another parallel. For centuries, manuscript production was laborious, requiring skilled scribes and expensive materials. The printing press didn't just make books cheaper; it democratized knowledge production itself. Within 50 years of Gutenberg's invention, more books were printed than had been hand-copied in the previous millennium.

What these transitions share is a pattern: initial resistance based on legitimate concerns about security and trust, followed by gradual recognition that the new system enables possibilities the old one couldn't. The telegraph didn't just speed up mail delivery; it created entirely new forms of commerce and communication. Ethereum's transition follows this historical arc.

Understanding why PoS consumes less energy requires grasping what miners actually did. PoW mining involves generating trillions of random numbers per second, checking each one to see if it satisfies specific mathematical criteria. It's like trying to find a specific grain of sand on a beach by examining grains one at a time. The difficulty adjusts automatically to maintain a constant block production rate, so as more miners join with more powerful hardware, the puzzle becomes harder.

This creates a perpetual hardware race. Mining operations invest millions in specialized ASIC chips designed solely for this computation. These facilities resemble data centers, with rows of machines generating enormous heat. Before The Merge, Ethereum's energy consumption rivaled that of Austria, while Bitcoin still consumes electricity comparable to Argentina or Poland.

PoS validators, by contrast, can run on modest hardware. A laptop or even a Raspberry Pi with a stable internet connection suffices. The energy requirement is comparable to streaming video, not operating an industrial furnace. The Ethereum Foundation estimates that post-Merge validators collectively use about the same energy as a small town of 2,000 homes.

The validator selection process uses a cryptographic function called RANDAO, which generates pseudo-random numbers based on validator contributions. Every 12 seconds, the network selects one validator to propose a block and a committee of validators to attest to its validity. Validators earn rewards for correct attestations and proposals, currently yielding approximately 3-4% annually on staked ETH.

Security doesn't come from computational work but from economic incentives. If your validator goes offline or signs conflicting messages, you lose money through inactivity penalties or slashing. If you perform well consistently, you earn steady rewards. The system is designed so that honest participation is always more profitable than attacks.

For Ethereum miners, The Merge was an extinction event. Overnight, billions of dollars in specialized mining equipment became effectively worthless for Ethereum. Some miners redirected their hardware to other PoW chains like Ethereum Classic or Ravencoin, but these networks couldn't absorb all that capacity. The hashrate exodus was immediate and dramatic.

Validators face entirely different economics. The 32 ETH requirement creates a significant entry barrier, approximately $96,000 in early 2025. However, this isn't consumed like electricity in mining; it's capital that validators retain ownership of, though it's locked and at risk of slashing. Ethereum co-founder Vitalik Buterin has proposed reducing this requirement to 1 ETH, which would dramatically expand access.

Staking pools have emerged as an alternative. Services like Lido or Rocket Pool allow users to stake smaller amounts by pooling resources. These platforms take a commission, typically 5-10%, but enable participation for those who can't meet the 32 ETH threshold. As of early 2025, roughly 18 million ETH is staked, representing about 15% of the total supply.

The reward structure differs fundamentally from mining. Miners received newly created cryptocurrency plus transaction fees, with rewards going to whoever solved the puzzle first. Validators earn consistent returns based on their stake size and uptime. Current annual yields hover around 3-4%, though this fluctuates based on network activity and total ETH staked.

This shift changes who benefits from network security. Mining rewarded those with capital for hardware and access to cheap electricity, often concentrating in regions with hydroelectric or fossil fuel abundance. Staking rewards those with capital to lock up, accessible to anyone with sufficient ETH regardless of location or energy access. The barrier shifts from operational to capital-based.

The environmental improvement is staggering, but the societal implications extend further. Consider what it means for blockchain adoption in jurisdictions with strict environmental regulations. The European Union's Markets in Crypto-Assets (MiCA) regulation includes provisions addressing cryptocurrency's environmental impact. PoS networks face fewer regulatory headwinds than PoW, potentially accelerating institutional adoption.

Educational institutions are taking notice. Universities previously hesitant to accept cryptocurrency donations due to environmental concerns now see PoS networks differently. Stanford's blockchain research lab expanded its Ethereum research following The Merge. Endowments evaluating crypto exposure can now consider ESG criteria without the carbon footprint problem.

The transition also affects geopolitics of energy. Bitcoin mining has become a tool of statecraft in some nations, with countries like Kazakhstan and Iran using excess energy capacity to attract mining operations. Ethereum's shift away from this model reduces cryptocurrency's role in energy politics. It's a subtle change, but one that removes a potential vector for resource nationalism in digital assets.

For developing nations, the implications are mixed. Mining offered economic opportunities in regions with cheap, often renewable, energy but limited industrial development. Validators need capital more than energy, which may concentrate participation among wealthier individuals and institutions. However, the lower operational costs could enable new forms of participation through pooling mechanisms.

The cultural shift within the crypto community is profound. Environmental criticism has been the single most potent argument against cryptocurrency adoption among mainstream audiences. PoS provides a powerful counternarrative. Ethereum advocates can now claim alignment with sustainability goals, changing the conversation from defensive justification to positive impact.

The energy savings create a permission structure for innovation. Developers no longer need to justify every new application against environmental costs. This psychological shift matters. Building on Ethereum pre-Merge meant accepting criticism about carbon footprints. Post-Merge, that burden lifts.

Scalability improvements become possible. The Merge itself didn't increase transaction throughput, but it enabled future upgrades that will. "Sharding," planned for implementation in coming years, will split the network into parallel chains. This architecture works far better with PoS than PoW because validators can be assigned to specific shards without the hardware constraints of mining.

Financial accessibility expands through staking pools. Someone with 0.1 ETH can now earn yield by participating in network security, something impossible in the mining era. This democratizes access to what is essentially the blockchain's equivalent of bond yields or savings account interest.

Security characteristics improve in subtle ways. PoW mining pools could theoretically collude to attack the network, and the hardware investment was their only deterrent. PoS slashing creates a direct financial penalty that persists even if hardware can be repurposed. The economic security model is cleaner and more transparent.

Network issuance rates dropped dramatically. Under PoW, Ethereum issued roughly 13,000 ETH daily to miners. Post-Merge, issuance fell to about 1,600 ETH daily, with transaction fees burning additional supply through EIP-1559. This creates deflationary pressure, potentially making ETH an appreciating asset over time.

Centralization concerns are real. The 32 ETH requirement, while lower than mining hardware costs, still creates barriers. Large staking pools like Lido control significant portions of staked ETH, raising concerns about concentrated influence. If a single entity controls over 33% of validators, they can potentially disrupt finality. At 51%, they could execute attacks.

Slashing, while theoretically straightforward, introduces new risks for validators. Technical failures, software bugs, or simply being offline during critical moments can result in financial penalties. This creates a professionalization pressure where running validators becomes specialized knowledge rather than broadly accessible.

The "nothing at stake" problem remains a theoretical concern. In PoW, miners must choose which chain to mine because computational power can't be duplicated. In PoS, validators could theoretically validate multiple competing chains simultaneously. Ethereum addresses this through slashing conditions that penalize validators caught signing conflicting blocks, but the theoretical attack vector persists.

Long-term security under different economic conditions is untested. PoW has operated for over a decade through various market cycles. PoS at Ethereum's scale is relatively new. What happens during severe bear markets when staking yields drop and the capital locked in validators loses dollar value? Will validators remain committed, or will mass withdrawals threaten security?

Regulatory uncertainty continues. Some jurisdictions may treat staking differently than mining for tax purposes. Is staking yield considered income when earned or when withdrawn? Are staking pools securities? These questions lack clear answers, creating legal ambiguity for participants.

European regulators view The Merge favorably. The EU's sustainability framework for financial products increasingly considers environmental impact. Ethereum's reduced footprint positions it more favorably for institutional adoption within European markets. France's central bank has been particularly vocal about preferring PoS networks for potential digital euro pilots.

In China, where cryptocurrency mining was banned in 2021, the distinction between PoW and PoS creates interesting dynamics. While trading remains restricted, the government's blockchain ambitions focus on energy-efficient consensus mechanisms. Ethereum's transition validates approaches that Chinese blockchain projects have emphasized.

Silicon Valley investors increasingly view PoS as the legitimate path forward. Venture capital flowing into blockchain infrastructure overwhelmingly targets PoS networks or layer-2 solutions built on them. Major funds explicitly cite environmental concerns in their investment theses, favoring projects that can demonstrate sustainability credentials.

Developing nations present diverse responses. El Salvador, which made Bitcoin legal tender, has defended PoW through volcano-powered geothermal mining. But countries exploring central bank digital currencies (CBDCs) almost universally examine PoS or similar efficient consensus mechanisms. Nigeria's eNaira, launched in 2021, uses a permissioned PoS variant.

Environmental organizations remain cautiously optimistic. Groups like the Rocky Mountain Institute, previously critical of all cryptocurrency, acknowledge PoS as a significant improvement. However, they note that Ethereum represents just one network. Bitcoin, the largest and most energy-intensive, shows no signs of transitioning away from PoW.

For those considering validation, the calculus has changed. Rather than evaluating electricity costs and hardware availability, prospective validators must assess capital requirements and risk tolerance. Understanding slashing conditions and maintaining validator uptime becomes crucial. Technical knowledge remains important, but the skillset shifts from hardware management to risk management.

Developers building on Ethereum now have clearer sustainability messaging. Projects can promote environmental benefits rather than defend environmental costs. This particularly matters for applications targeting mainstream users or institutions with ESG commitments. NFT platforms, DeFi protocols, and gaming applications can all leverage improved environmental credentials.

Investors should understand how staking changes Ethereum's economic model. With issuance dropping and transaction fees burning supply, ETH exhibits characteristics similar to productive assets. Staking yields resemble dividend yields, making fundamental valuation frameworks more applicable. The question shifts from speculative "will it go up?" to analytical "what's the real yield?"

For skeptics reconsidering crypto, The Merge removes the strongest environmental objection. That doesn't mean all concerns evaporate, but it does eliminate one significant barrier. If environmental impact was your primary hesitation, Ethereum now operates at a footprint comparable to traditional online services.

The broader lesson extends beyond Ethereum. When Bitcoin launched in 2009, PoW seemed like the only way to achieve decentralized consensus without trusted parties. Fifteen years later, we've learned that multiple viable approaches exist. Innovation in consensus mechanisms continues, with networks experimenting with Delegated PoS, Byzantine Fault Tolerance variants, and hybrid models.

Ethereum's transition from PoW to PoS represents more than a technical upgrade. It's a demonstration that established systems, even decentralized ones with billions of dollars at stake, can execute fundamental architectural changes. The network processed millions of transactions daily, secured hundreds of billions in value, and managed to swap its consensus engine mid-flight without catastrophic failure.

This creates precedent. Other blockchains now face questions about why they maintain energy-intensive consensus mechanisms. Bitcoin maximalists argue that PoW's energy consumption is a feature, not a bug, providing objective proof of resource expenditure. That philosophical position grows harder to defend as alternatives demonstrate comparable security with 99.95% less energy consumption.

The coming years will test whether PoS provides long-term security equivalent to PoW. Ethereum's roadmap extends far beyond The Merge, with planned upgrades to further improve scalability and efficiency. The validator set continues growing, with proposals to reduce the 32 ETH requirement potentially bringing thousands more participants.

What looked impossible five years ago is now operational reality. A network worth over $300 billion completely transformed its fundamental architecture, reducing environmental impact to a rounding error while maintaining security and functionality. Whether this transformation succeeds long-term remains to be seen. But the fact that it happened at all demonstrates that technological evolution in decentralized systems is not just possible but achievable.

The miners who once secured Ethereum are gone, replaced by validators with locked capital and economic incentives. The energy that once powered computational races now flows elsewhere. And blockchain technology, so often criticized for environmental excess, has proven it can evolve toward sustainability without sacrificing the decentralization that makes it valuable. That evolution continues, and what comes next will determine whether The Merge was merely impressive or truly transformative.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

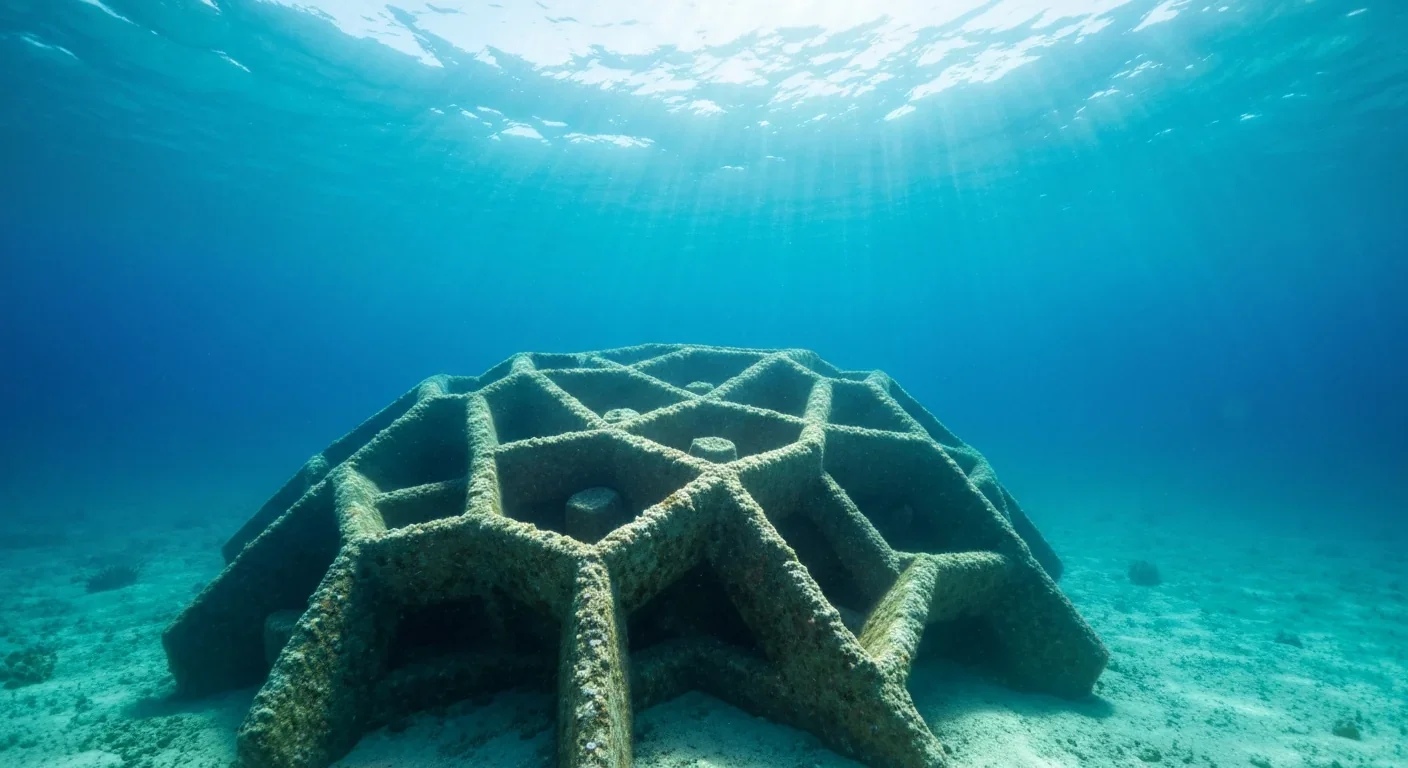

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

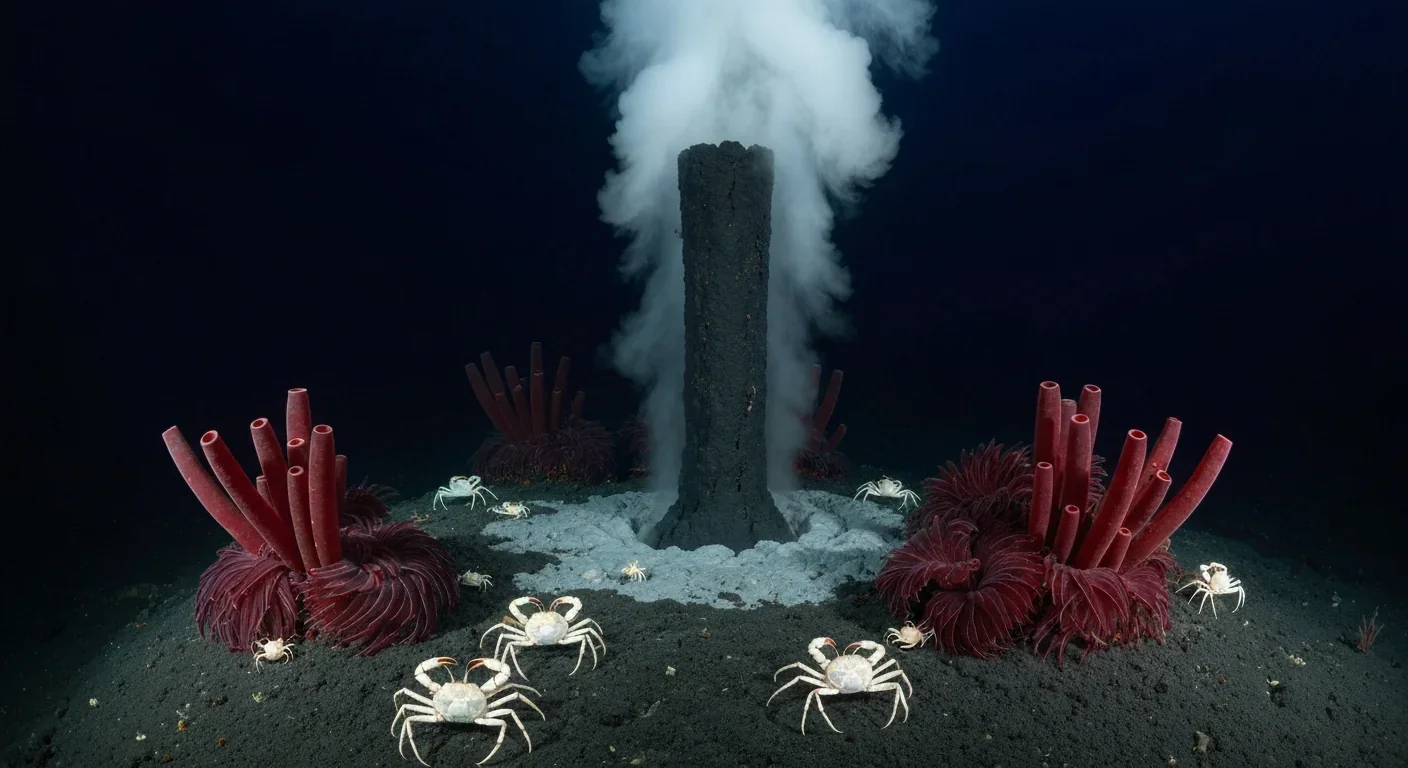

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

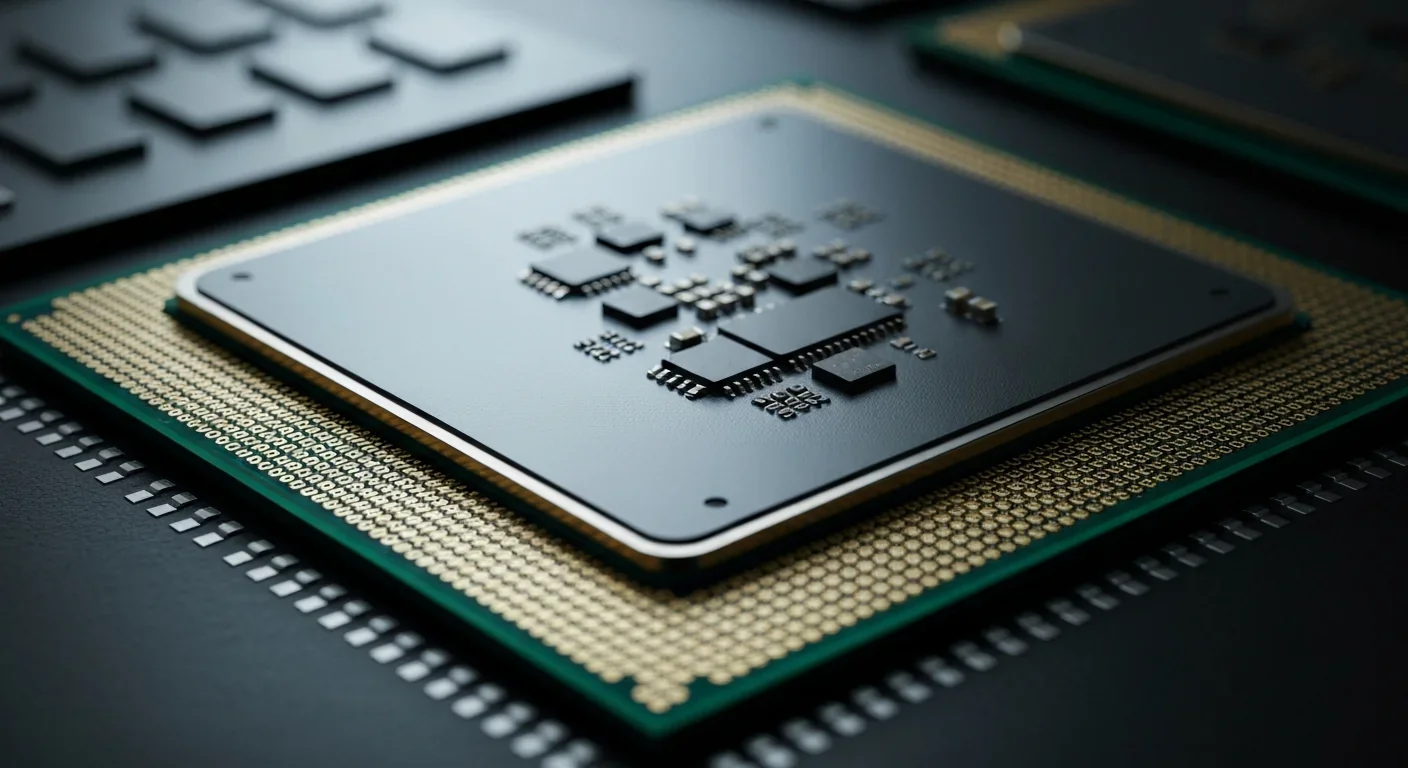

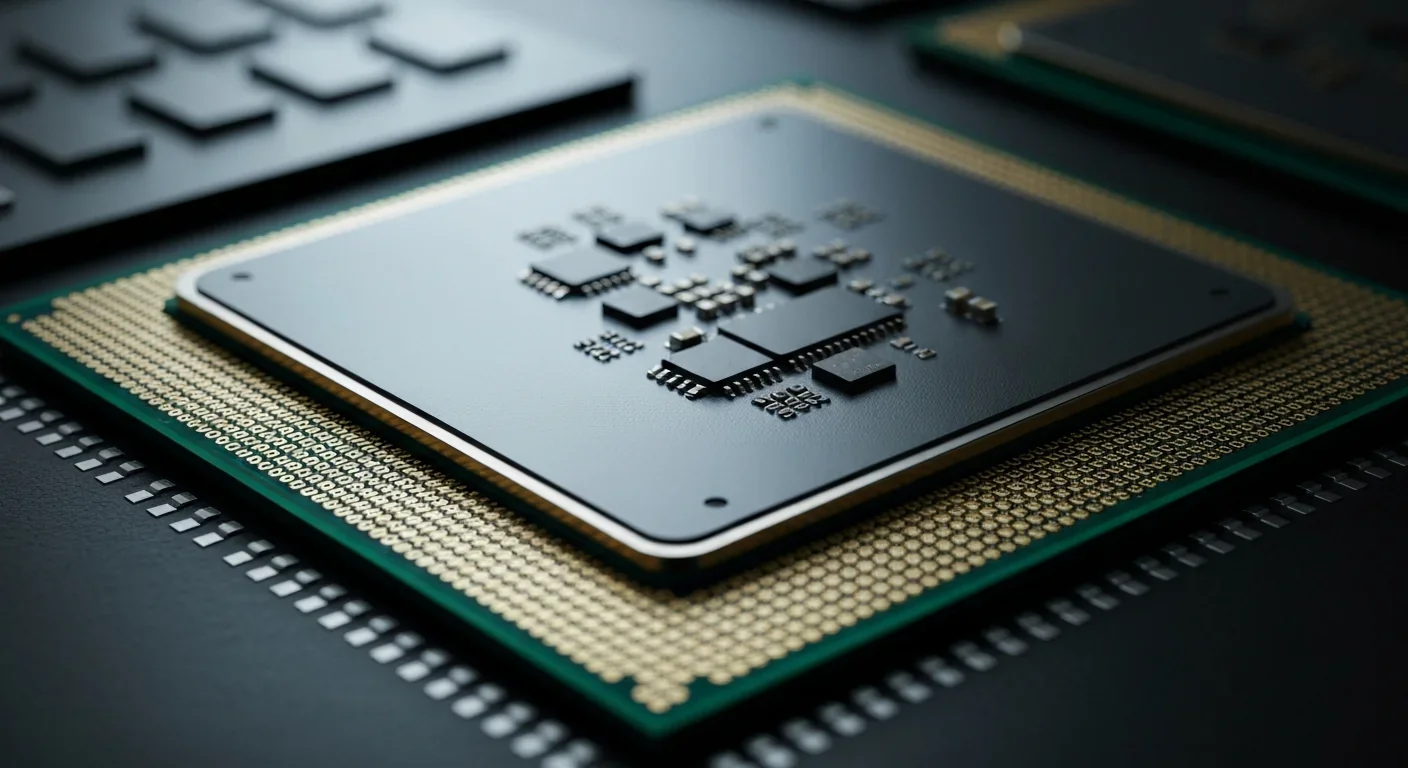

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.