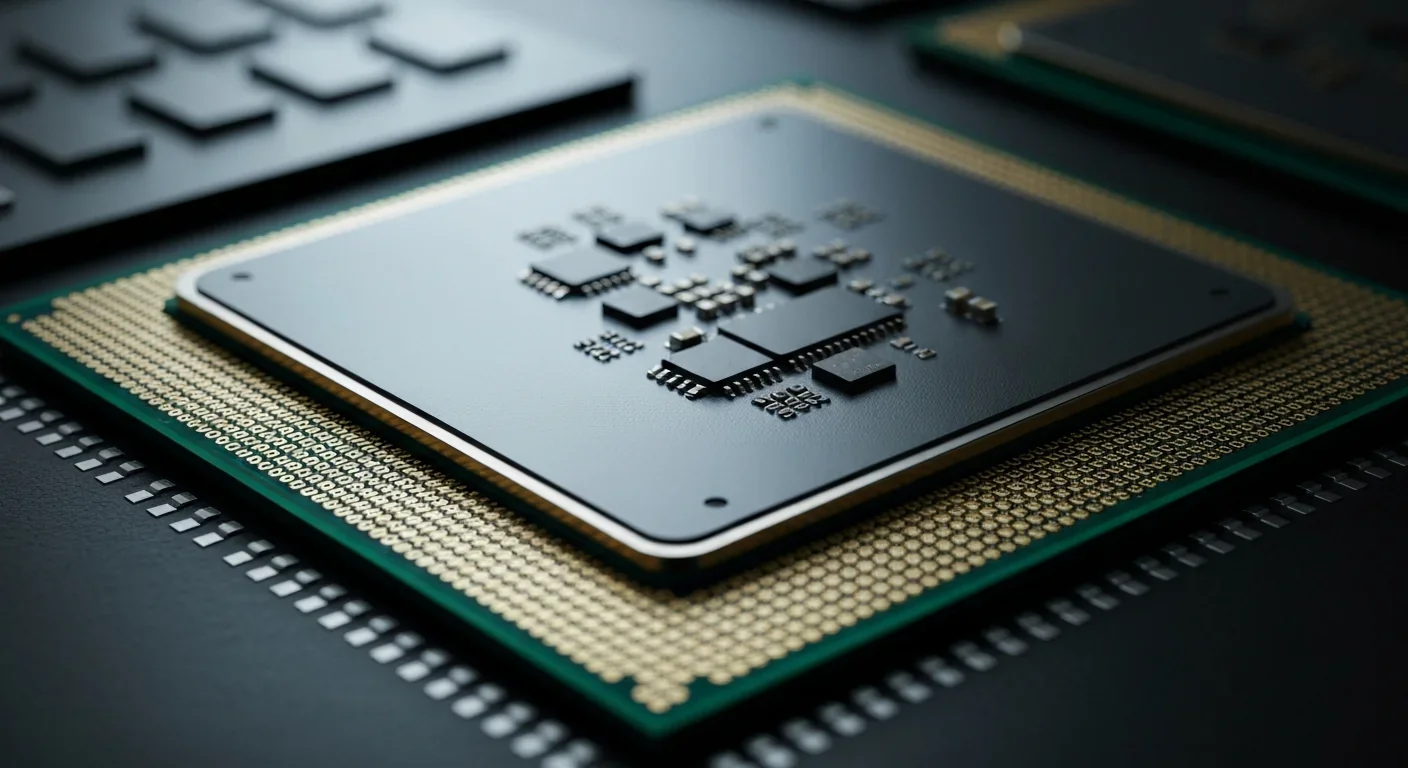

Cache Coherence Protocols: MESI and MOESI Explained

TL;DR: Bitcoin mining now consumes 198.75 TWh annually - more than Thailand - with a single transaction emitting as much CO₂ as driving from New York to LA. While proof-of-stake alternatives like Ethereum have slashed energy use by 99.95%, Bitcoin's proof-of-work remains energy-intensive by design, sparking debates over renewable mining, regulatory approaches, and whether decentralization can coexist with sustainability.

By 2030, the electricity consumed by Bitcoin mining could exceed that of Japan. Right now, the network already devours 198.75 terawatt-hours annually - enough to power Thailand for a year. To put that in perspective, every time you make a single Bitcoin transaction, you're responsible for emissions equivalent to driving a gas-powered car nearly 1,500 miles. This isn't just an environmental curiosity anymore. It's reshaping energy markets, straining power grids, and forcing policymakers worldwide to grapple with a question no one saw coming a decade ago: What happens when digital money starts competing with cities for electricity?

Bitcoin's astronomical energy consumption wasn't an accident. It was baked into the system from day one. When Satoshi Nakamoto designed Bitcoin in 2008, he chose a mechanism called proof-of-work to secure the network without needing a central authority. The idea was elegant: miners around the world would compete to solve complex mathematical puzzles, and whoever solved it first would add the next block to the blockchain and earn newly minted bitcoin as a reward.

What nobody fully anticipated was the arms race this would trigger. In the early days, you could mine Bitcoin on a laptop. Within a few years, miners had moved to specialized hardware called ASICs - chips designed for one purpose only: computing hash functions as fast as possible. Today's mining operations look more like data centers than hobbyist setups, with thousands of machines running 24/7 in warehouse-sized facilities.

The numbers tell the story. According to the Digiconomist Bitcoin Energy Consumption Index, Bitcoin's total mining revenue topped $18.9 billion last year, with electricity costs devouring 52.67% of that revenue. That's nearly $10 billion spent just on power. And as Bitcoin's price climbs, so does the incentive to throw more computing power at the problem, creating a feedback loop that drives energy consumption ever higher.

But here's what makes this particularly thorny: the energy use is a feature, not a bug. The whole point of proof-of-work is to make it prohibitively expensive to attack the network. The more computing power securing Bitcoin, the safer it becomes. It's security through energy expenditure, and it works - Bitcoin has never been successfully hacked at the protocol level. The question is whether that security is worth the environmental cost.

This isn't the first time humanity has faced the dilemma of a transformative technology with enormous energy requirements. Consider the rise of aluminum production in the late 19th century. When Charles Martin Hall invented an economical method for extracting aluminum from ore in 1886, it required massive amounts of electricity - so much that aluminum smelters became some of the largest industrial consumers of power. Critics called it wasteful. But aluminum went on to revolutionize aviation, construction, and manufacturing. Today, we barely question the energy cost because the benefits seem obvious.

Or take the internet itself. In the 1990s, few predicted that data centers and network infrastructure would one day consume 1-2% of global electricity. Yet we've collectively decided that email, streaming video, and social media are worth it. The difference with Bitcoin is that its value proposition isn't universally accepted. For believers, it's a hedge against inflation and government overreach. For skeptics, it's a speculative asset with no intrinsic value.

The printing press offers another parallel. When Johannes Gutenberg introduced movable type in the 1440s, it didn't require vast energy resources, but it did trigger social upheaval. The Catholic Church feared the spread of heretical ideas. Governments worried about losing control of information. Yet the printing press democratized knowledge in ways that reshaped civilization. Could Bitcoin do something similar for money?

History suggests that we rarely see the full consequences of a technology until decades after its introduction. The first automobiles were slower than horses and broke down constantly. Early aircraft were death traps. Bitcoin is only 16 years old. Whether it becomes infrastructure we can't imagine living without - or a cautionary tale about misallocated resources - remains an open question.

To understand why Bitcoin uses so much energy, you need to grasp how proof-of-work actually functions. Imagine you're trying to secure a vault, but instead of a physical lock, you're using a mathematical puzzle so difficult that it takes thousands of supercomputers working simultaneously to solve it every ten minutes.

Here's what happens: miners collect pending transactions into a block, then search for a special number called a nonce. When you combine the block's data with this nonce and run it through a cryptographic hash function, you get a random-looking string of characters. The goal is to find a nonce that produces a hash starting with a specific number of zeros. Sounds simple, right?

It's not. The only way to find the right nonce is trial and error - billions upon billions of guesses per second. The Bitcoin network automatically adjusts the difficulty every 2,016 blocks (about two weeks) to keep the average time between blocks at ten minutes. If more miners join, the puzzle gets harder. If they leave, it gets easier. This self-adjusting difficulty is why Bitcoin's energy consumption scales with its value: as the price rises, mining becomes more profitable, attracting more miners, which increases difficulty and energy use.

The entire Bitcoin network currently operates at roughly 400 exahashes per second. That's 400,000,000,000,000,000,000 calculations every second. To put that in perspective, if every person on Earth owned a modern laptop and used it exclusively for Bitcoin mining, we still wouldn't match the network's current hash rate.

Each of those calculations requires electricity. Modern ASIC miners are remarkably efficient - they can perform about 100 terahashes per second while drawing 3,000 watts. But efficiency doesn't matter much when you're scaling to this magnitude. It's like bragging that your fleet of a million trucks gets slightly better gas mileage. You're still burning an ocean of fuel.

The carbon footprint is where Bitcoin's energy appetite becomes genuinely alarming. A single Bitcoin transaction emits 664.53 kg of CO₂ - equivalent to 1,472,834 Visa transactions or driving a passenger car from New York to Los Angeles. That's not a typo. One Bitcoin transaction has roughly the same carbon impact as driving coast to coast.

The reason comes down to where Bitcoin gets its power. Despite industry claims about renewable energy, a Cambridge study found that after China's 2021 mining crackdown, the share of renewables powering Bitcoin plummeted from 41.6% to 25.1%. Many mining operations simply relocated to regions with cheap electricity, regardless of the source. Kazakhstan, powered largely by coal, became a major mining hub. So did parts of the United States reliant on natural gas.

Beyond carbon, there's the water issue. A 2023 study found that a single Bitcoin transaction consumes as much water as filling a backyard swimming pool - about 16,000 liters - when you account for the water needed to cool power plants and mining facilities. In water-stressed regions, this creates direct competition between cryptocurrency operations and agricultural or residential needs.

The e-waste problem compounds the damage. ASIC miners become obsolete quickly as manufacturers release more efficient models. These specialized chips can't be repurposed for anything else, so they end up in landfills. Bitcoin generates an estimated 30,700 metric tons of e-waste annually, equivalent to the small IT equipment waste of a country like the Netherlands.

And then there's the grid strain. In Texas, Bitcoin miners consumed so much power during the 2022 heat wave that they were paid millions to shut down temporarily and avoid blackouts. In upstate New York, a dormant coal plant was reactivated specifically to power a Bitcoin mining operation. These aren't hypothetical impacts - they're happening now, in communities where residents saw their electricity bills spike because miners moved in next door.

For all the criticism, Bitcoin mining is a sophisticated business with complex economics. Miners aren't just burning electricity for fun. They're calculating profitability down to the kilowatt-hour, and the math only works in regions with cheap power. That's why mining has concentrated in places like Iceland (geothermal), Paraguay (hydroelectric), and Texas (wind and natural gas).

The revenue model is straightforward: miners earn newly created bitcoin (the "block reward," currently 6.25 BTC per block) plus transaction fees. At today's prices, that's roughly $200,000 per block. But they're competing against thousands of other miners, and only one wins each round. The expected value depends on your share of the global hash rate.

This creates an interesting dynamic. When Bitcoin's price drops, marginal miners - those with higher electricity costs - shut down because they're losing money. The network's hash rate falls, difficulty adjusts downward, and remaining miners become more profitable. It's a self-balancing system, but one with real-world consequences. During Bitcoin's 2022 crash, several publicly traded mining companies went bankrupt, leaving abandoned warehouses full of idle equipment.

The industry argues that Bitcoin mining can actually support renewable energy development. The logic goes like this: renewable energy is intermittent - solar panels don't work at night, wind turbines don't spin when the air is still. Bitcoin miners can act as "buyers of last resort," consuming excess renewable energy that would otherwise go to waste. Some renewable energy projects have been financed partly on the promise of selling surplus power to miners.

Critics counter that this is wishful thinking. In practice, miners go wherever electricity is cheapest, not cleanest. And while they might consume some stranded renewable energy, the vast majority of Bitcoin's power still comes from fossil fuels. The question isn't whether Bitcoin mining can use renewables - obviously it can - but whether market incentives will drive it in that direction without regulation.

Not all cryptocurrencies work this way. Ethereum, once the second-largest energy consumer in crypto, completed its transition to proof-of-stake in September 2022. Instead of miners competing with computational power, validators stake their own cryptocurrency as collateral. The network randomly selects validators to create new blocks, and if they misbehave, they lose their stake.

The energy savings were immediate and dramatic. Ethereum's electricity consumption dropped by 99.95% overnight. It went from consuming as much power as a small country to using less than a typical corporate data center. The security model is fundamentally different - instead of making attacks expensive through energy expenditure, proof-of-stake makes them expensive through financial risk.

Bitcoin maximalists argue that proof-of-stake is less secure, though evidence for this remains thin. Ethereum hasn't been successfully attacked since the merge. The real resistance to changing Bitcoin's consensus mechanism is ideological and practical: altering such a fundamental aspect of the protocol would require unprecedented consensus among a notoriously fractious community. Bitcoin's core value proposition is immutability and decentralization. Major protocol changes threaten both.

Still, some developers are working on hybrid approaches. Lightning Network, a "layer 2" solution built on top of Bitcoin, enables instant, low-energy transactions by settling only periodically on the main blockchain. If widely adopted, it could reduce the energy cost per transaction dramatically without changing Bitcoin's core protocol.

There's also hope in mining efficiency. Each generation of ASIC hardware delivers more hashes per watt. Theoretically, the network could maintain the same security level with less energy as hardware improves. But historically, efficiency gains get eaten up by increased hash rate. It's Jevons paradox: improvements in efficiency tend to increase total consumption because they make the activity more economically attractive.

Different nations are taking radically different approaches. China, once home to over 60% of Bitcoin mining, effectively banned the practice in 2021. A Chinese court even ruled that Bitcoin mining contracts were invalid because they "harm the national public interest" by contributing to climate change. The crackdown wasn't primarily environmental - authorities were worried about capital flight and financial stability - but the climate rationale provided useful political cover.

The mining exodus from China had profound effects. The U.S. became the world's largest Bitcoin mining hub almost overnight, now accounting for about 38% of global hash rate. Texas in particular became a hotspot due to its deregulated energy market and abundance of cheap natural gas. But this created new problems: during the February 2021 winter storm, some critics blamed Bitcoin miners for exacerbating grid instability (though the primary culprits were frozen natural gas infrastructure and poor winterization).

Europe is taking a more nuanced stance. The EU hasn't banned proof-of-work, but it's considering regulations that would require energy-intensive cryptocurrencies to disclose their environmental impact. Sweden and Norway have called for an EU-wide ban on proof-of-work mining, arguing that the electricity should go toward decarbonization efforts instead. Meanwhile, Iceland and Norway, with their abundant renewable energy, continue to host significant mining operations.

In developing nations, the picture is even more complex. Kazakhstan briefly became the world's second-largest mining hub after China's ban, but quickly discovered that its grid couldn't handle the load. Rolling blackouts became common. The government responded with higher taxes on miners and energy rationing. El Salvador, which made Bitcoin legal tender in 2021, is trying to power its mining operations with geothermal energy from volcanoes - a creative solution, but one that only works in tectonically active regions.

The lack of international coordination creates a regulatory arbitrage problem. If one country bans mining, operations simply move elsewhere. Some experts argue that only a global framework, similar to international climate agreements, could meaningfully address Bitcoin's energy consumption. But cryptocurrency's entire appeal is its resistance to centralized control. Getting nations to coordinate on Bitcoin regulation might be even harder than getting them to coordinate on climate policy.

So what should investors, policymakers, and everyday people do with this information?

For investors, the calculation is increasingly complicated. Bitcoin's energy consumption is now a material risk. Companies holding large Bitcoin positions face reputational and regulatory risks. Environmental, Social, and Governance (ESG) funds are divesting from Bitcoin-heavy portfolios. On the other hand, miners who can demonstrate reliance on renewable energy or who participate in grid-balancing schemes may find themselves at a competitive advantage as regulations tighten.

Policymakers face a thornier challenge. Outright bans are difficult to enforce - mining operations can be run from anywhere with an internet connection and cheap electricity. But targeted policies can work. Carbon pricing would naturally penalize fossil-fueled mining without banning the practice. Grid connection fees for large-scale mining operations could internalize some of the infrastructure costs. Requiring energy disclosure and establishing renewable energy mandates for miners would create market incentives toward cleaner power.

For the general public, understanding Bitcoin's energy consumption is crucial for making informed decisions about whether and how to participate in cryptocurrency. If you're buying Bitcoin, you're implicitly endorsing its energy-intensive security model. That doesn't mean you shouldn't - maybe you believe the benefits outweigh the costs - but you should make that choice consciously, not ignorantly.

There's also a broader question about what we value as a society. We collectively accept that our financial system consumes energy - bank branches, ATMs, data centers, armored trucks moving cash. Bitcoin advocates argue their system is more transparent about its energy use, not necessarily worse. That comparison is debatable, but it's worth having the conversation honestly.

The most likely scenario isn't Bitcoin collapsing under the weight of its energy consumption, nor regulators forcing a switch to proof-of-stake. It's probably continued evolution: incremental efficiency improvements, gradual migration to renewable energy sources, development of layer-2 solutions that reduce reliance on energy-intensive base-layer transactions, and regional regulations that shape where and how mining happens without killing the industry entirely.

Bitcoin's energy consumption is a problem, but it's a solvable one if we're willing to apply the same engineering creativity and market forces that created Bitcoin in the first place. The question is whether we'll solve it fast enough to matter for the climate - and whether the solution will preserve what Bitcoin's supporters value most about it. That tension between decentralization and sustainability might define cryptocurrency's next chapter, and its resolution will tell us a lot about what kind of future we're willing to build.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

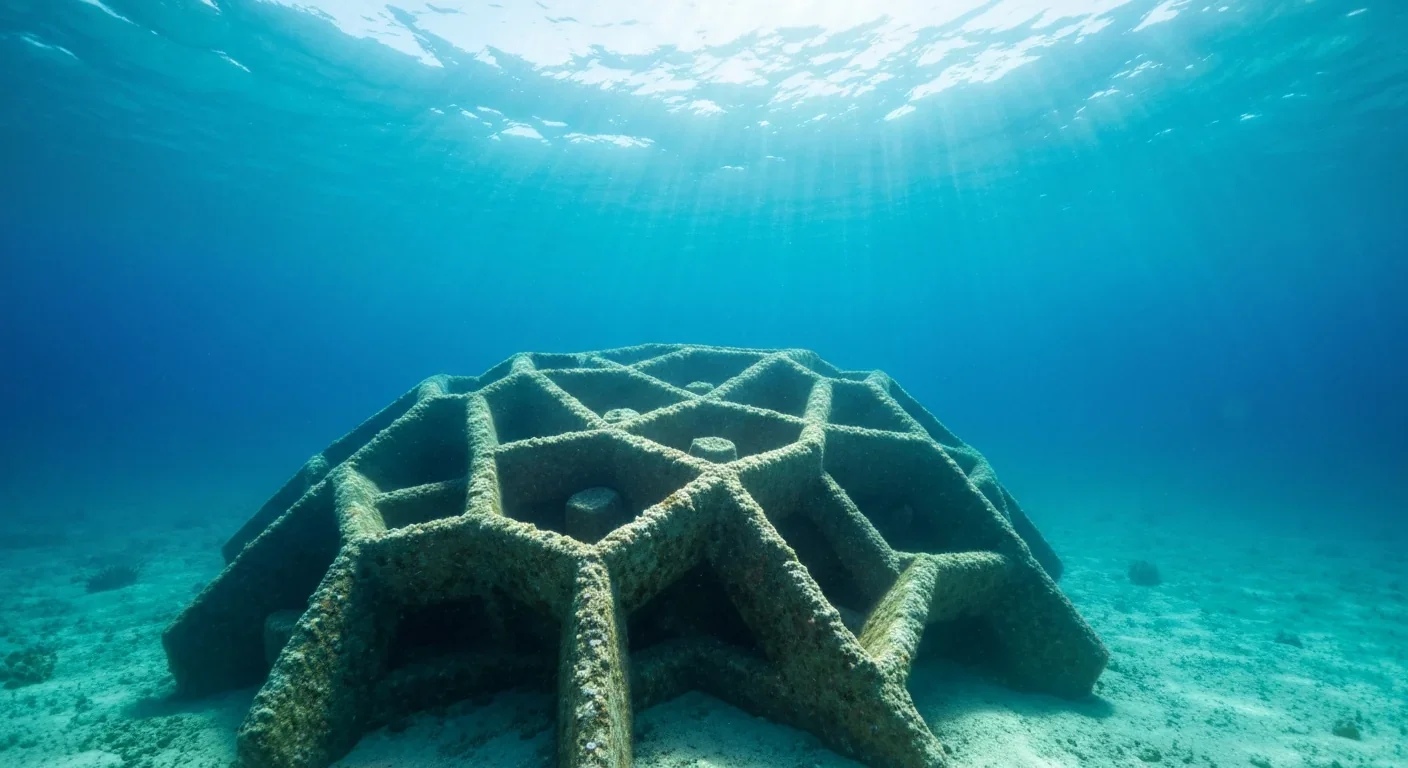

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

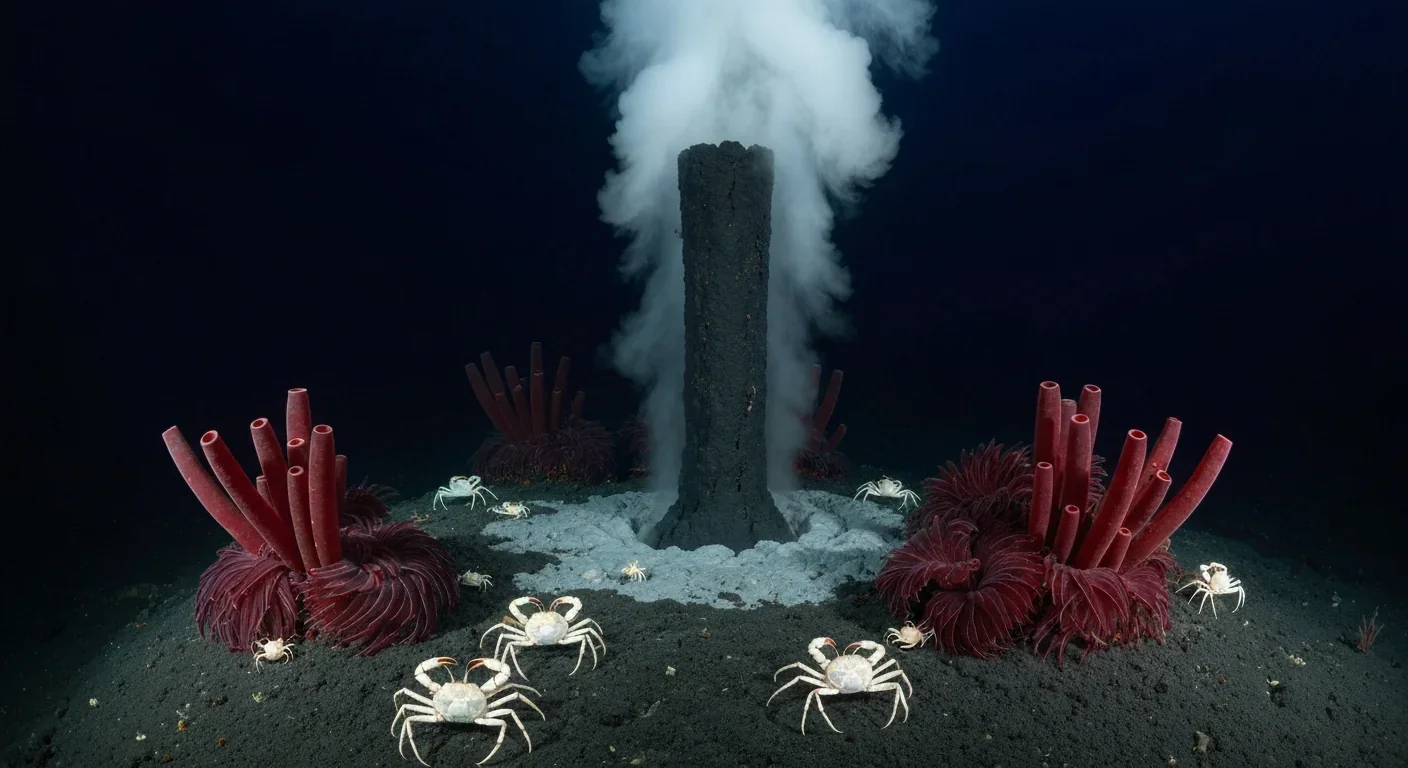

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.