Cache Coherence Protocols: MESI and MOESI Explained

TL;DR: Blockchains face an impossible choice: they can be fast, secure, or decentralized, but never all three at once. This fundamental constraint shapes every cryptocurrency, from Bitcoin's slow but resilient network to Solana's blazing speed at the cost of centralization.

Every blockchain developer faces the same impossible choice: build something fast, build something secure, or build something truly decentralized. You can't have all three. This isn't a temporary limitation waiting for the next technical breakthrough. It's a fundamental constraint, as unchangeable as the laws of thermodynamics. The blockchain trilemma shapes every cryptocurrency you've ever heard of, determining which promises each project must break.

Think of the blockchain trilemma as a three-way tug-of-war where everyone loses. Pull toward speed, and you sacrifice either security or decentralization. Optimize for security, and you'll move slowly or concentrate power. Achieve true decentralization, and you'll crawl along at Bitcoin's seven transactions per second while hoping no one with enough computing power decides to rewrite history.

The term itself comes from Vitalik Buterin, who formalized what blockchain architects already knew in their bones: you can't maximize all three properties simultaneously. Proof-of-work systems like Bitcoin chose security and decentralization, accepting glacial transaction speeds as the price. Newer networks went different directions, and their choices reveal everything about their actual priorities versus their marketing claims.

Here's what makes this genuinely hard. Speed requires quick decisions, which means fewer validators checking each transaction. Security demands redundancy, with multiple nodes verifying everything, which takes time. Decentralization insists that thousands of independent participants can validate transactions, but coordinating thousands of anything is slow. The math doesn't work. Something has to give.

When Satoshi Nakamoto designed Bitcoin, speed wasn't even on the priority list. The network processes roughly seven transactions per second, making it slower than a 1970s credit card terminal. But those seven transactions per second are nearly impossible to fake or reverse.

Bitcoin's proof-of-work system requires massive computational effort to add each block. Miners worldwide compete to solve mathematical puzzles, burning enough electricity to power entire countries. This waste is actually the point. To rewrite Bitcoin's history, you'd need to control more computing power than everyone else combined, then redo all that energy-intensive work. It's expensive enough to be impractical.

The network stays decentralized because anyone with electricity and hardware can participate. Thousands of nodes across every continent maintain copies of the blockchain. No company controls it. No government can shut it down by raiding headquarters, because there are no headquarters. This resilience comes at the cost of speed and energy efficiency.

Ethereum started with Bitcoin's model but grew frustrated with its limitations. Running complex smart contracts on a network that processes seven transactions per second felt like trying to stream video over a dial-up connection. So Ethereum switched from proof-of-work to proof-of-stake in 2022, cutting energy consumption by 99.84%.

Proof-of-stake replaces mining with staking. Instead of burning electricity to prove commitment, validators lock up cryptocurrency, currently 32 ETH for Ethereum. This barrier to entry worries some observers, who note that requiring $60,000 worth of ETH concentrates validation power among the wealthy. You've traded energy waste for wealth requirements, and it's not obvious that's better for decentralization.

The network did get faster and cheaper to run. Ethereum now processes around 30 transactions per second, quadruple Bitcoin's throughput. But that's still nowhere near Visa's thousands of transactions per second. The real speed comes from layer-2 solutions built on top of Ethereum, which introduces another set of trade-offs.

Layer-2 networks like Optimistic Rollups and ZK Rollups process transactions off the main chain, periodically settling batches back to Ethereum. This works because you're trusting a smaller set of validators. Optimistic rollups assume transactions are valid unless someone challenges them. ZK rollups use cryptographic proofs that are mathematically sound but require specialized knowledge to verify. Either way, you're introducing trust assumptions that didn't exist on the base layer.

Solana took the opposite bet. The network claims theoretical throughput of 65,000 transactions per second, making it one of the fastest blockchains ever built. Transactions cost fractions of a penny and confirm in seconds. This performance comes from aggressive optimization and, critics argue, sacrificing decentralization.

Running a Solana validator requires serious hardware. You need enterprise-grade servers with specific specifications, putting participation out of reach for casual users. The network has around 1,900 validators, which sounds decentralized until you realize Ethereum has over 900,000. Fewer validators means faster consensus but more concentration of power.

Solana has also experienced multiple network outages, with the blockchain going dark for hours at a time. These failures happened because the network's speed makes it vulnerable to spam attacks that overwhelm validators. You can't have thousands of transactions per second if you stop to carefully verify each one. The throughput is real, but so is the fragility.

The Solana team argues these are growing pains that will resolve with better engineering. Maybe they're right. But the outages reveal something fundamental about the trilemma. When you push one dimension to its limit, stress appears somewhere else.

Understanding why the trilemma exists requires thinking about what consensus actually means. A blockchain works because independent participants agree on a shared history. This agreement must happen despite adversaries trying to cheat, nodes going offline, and network delays creating different views of reality.

Getting agreement takes communication. Every validator needs to hear about transactions, verify them, and coordinate with others. The more validators you have, the more communication overhead you create. Network latency, bandwidth limits, and processing time all impose real constraints. You can't make physics disappear with clever code.

Research has formalized these trade-offs mathematically, proving that no consensus protocol can simultaneously maximize decentralization, security, and performance. The proof doesn't depend on current technology or algorithmic limitations. It's a fundamental property of distributed systems operating under adversarial conditions.

This matters because it means the trilemma isn't something blockchain version 5.0 will solve. Every proposed solution shifts trade-offs rather than eliminating them. Sharding splits the network into parallel chains, increasing throughput but fragmenting security. Proof-of-stake reduces energy waste but introduces plutocratic elements. Layer-2 solutions add speed by adding trust assumptions.

Developers keep trying to bend the trilemma, and some approaches show promise. Ethereum's roadmap includes sharding, which would split the network into 64 parallel chains, each processing its own transactions. The security of the main chain would protect all shards, theoretically giving you speed without sacrificing decentralization or security.

But sharding introduces complexity. Transactions that touch multiple shards need cross-shard communication, creating latency. An attacker might find it easier to compromise a single shard than the entire network. The engineering challenges have delayed sharding's implementation for years, and when it finally arrives, it won't eliminate trade-offs so much as redistribute them.

Zero-knowledge proofs offer another approach. These cryptographic techniques let you prove a calculation is correct without revealing the calculation itself or redoing the work. ZK rollups use this to process thousands of transactions off-chain, then submit a single proof to the main chain. The security guarantees remain strong because the math doesn't lie.

The catch is accessibility. Generating zero-knowledge proofs requires specialized hardware and expertise. Most users will depend on professional operators to run ZK rollup validators, which concentrates power even if the underlying mathematics is sound. You've traded one form of centralization for another, possibly a worthwhile trade but definitely still a trade.

Looking at major cryptocurrencies through the lens of the trilemma reveals what each network truly values. Bitcoin prioritizes security and decentralization, accepting slow transactions and high fees. This makes sense for a network positioning itself as digital gold rather than a payment system.

Ethereum tries to balance all three properties, leaning slightly toward decentralization and security. The shift to proof-of-stake improved efficiency without dramatically changing the fundamental compromise. Layer-2 solutions do the heavy lifting for speed, at the cost of fragmenting the ecosystem and introducing additional trust assumptions.

Solana unambiguously chose speed, betting that users care more about low fees and fast confirmations than maximizing decentralization. For many use cases like gaming or high-frequency trading, this might be the right call. But it means Solana will never achieve Bitcoin's censorship resistance or Ethereum's validator distribution.

Newer networks like Avalanche and Algorand experiment with novel consensus mechanisms, each making different trade-offs. Avalanche uses subnets to parallelize transaction processing, improving speed while letting different subnets optimize for different properties. Algorand's Pure Proof-of-Stake randomly selects validators for each block, aiming for speed and fairness but requiring trust in the randomness mechanism.

Of the three properties, decentralization is hardest to measure and easiest to fake. A network might have thousands of nodes, but if they're all running on the same cloud provider, an Amazon Web Services outage could take down the entire blockchain. Geographic distribution matters as much as node count.

Stake concentration is another concern. Ethereum requires 32 ETH to run a validator, but staking pools let small holders participate. This improves accessibility but concentrates power in pool operators. Lido, the largest staking pool, controls over 30% of staked ETH. That's not dangerous yet, but it trends in the wrong direction.

Governance adds another layer. Many proof-of-stake networks give voting power proportional to stake, which sounds democratic until you realize wealthy participants control decisions. This might be fine for protocol upgrades, but it contradicts the original cryptocurrency vision of power distributed equally among participants regardless of wealth.

Different applications need different trade-offs. Storing value long-term prioritizes security and decentralization over speed, making Bitcoin's design optimal. No one cares if a transaction takes ten minutes to settle if you're moving your life savings into an asset you'll hold for years.

Decentralized finance applications need more speed. Traders executing complex strategies across multiple protocols can't wait ten minutes between steps. They'll accept some centralization if it means transactions confirm in seconds rather than minutes. This explains why most DeFi activity happens on Ethereum layer-2s or alternative chains like Solana.

Gaming and social media push hardest for speed. A blockchain-based game where every action costs money and takes minutes to process isn't a game, it's a punishment. These applications will maximize throughput, accepting whatever centralization and security compromises come with it. The users don't care that the underlying network has only a few dozen validators.

The trilemma isn't going away, but understanding it helps evaluate new projects honestly. When someone promises a blockchain that's simultaneously fast, secure, and decentralized, they're either lying, confused, or using words differently than everyone else. Ask which property they're actually optimizing for, and which ones they're willing to compromise.

Modular blockchain designs might offer the most promising path forward. Instead of one network trying to do everything, separate specialized layers handle different functions. A base layer provides security and decentralization. Execution layers prioritize speed. Data availability layers ensure information remains accessible. Each layer optimizes for its specific role, and together they provide better overall performance than any single-layer design could achieve.

This approach doesn't eliminate trade-offs so much as distribute them more intelligently. Users who need maximum security stick to the base layer. Those who want speed move to execution layers, accepting the additional trust assumptions. The ecosystem becomes more complex, but complexity might be the price of working around fundamental limitations.

Next time you see marketing materials for a new blockchain, run it through the trilemma test. If they claim all three properties without qualification, that's a red flag. Look at validator requirements. How much does running a node cost? How many validators exist, and how are they distributed? How much stake do the top ten participants control?

Check the network's history during stress. Have there been outages? How quickly do transactions confirm during peak demand? What happens to fees when the network gets busy? These practical measures reveal real-world trade-offs better than theoretical claims.

Consider what you actually need. If you're buying cryptocurrency as an investment, Bitcoin's security and decentralization probably matter more than transaction speed. If you're building a gaming application, Solana's throughput might be worth the centralization trade-offs. If you want to participate in DeFi, Ethereum's balanced approach or its layer-2 ecosystem could be optimal.

The blockchain trilemma explains why cryptocurrency hasn't replaced traditional payment systems. Visa processes thousands of transactions per second with near-zero fees because it's a centralized system. One company controls the infrastructure, makes all decisions, and can optimize purely for performance. Blockchains trade that performance for properties Visa can never offer: censorship resistance, permissionless access, and independence from any single authority.

This isn't a failure of blockchain technology. It's a recognition that different systems excel at different things. Blockchains will never beat centralized databases on pure performance, and that's fine. The question isn't whether blockchains are faster than traditional systems, but whether their unique properties justify the performance trade-offs for specific applications.

As blockchain technology matures, we'll likely see more specialization. Networks optimized for different use cases, interconnected through bridges and common standards. Some will prioritize security for high-value transactions. Others will maximize speed for applications where throughput matters more than decentralization. The trilemma doesn't disappear, but understanding it helps build systems that make smart compromises rather than false promises.

The next time someone tells you they've solved the blockchain trilemma, ask them specifically which trade-offs they're making. Because they're definitely making some, whether they admit it or not.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

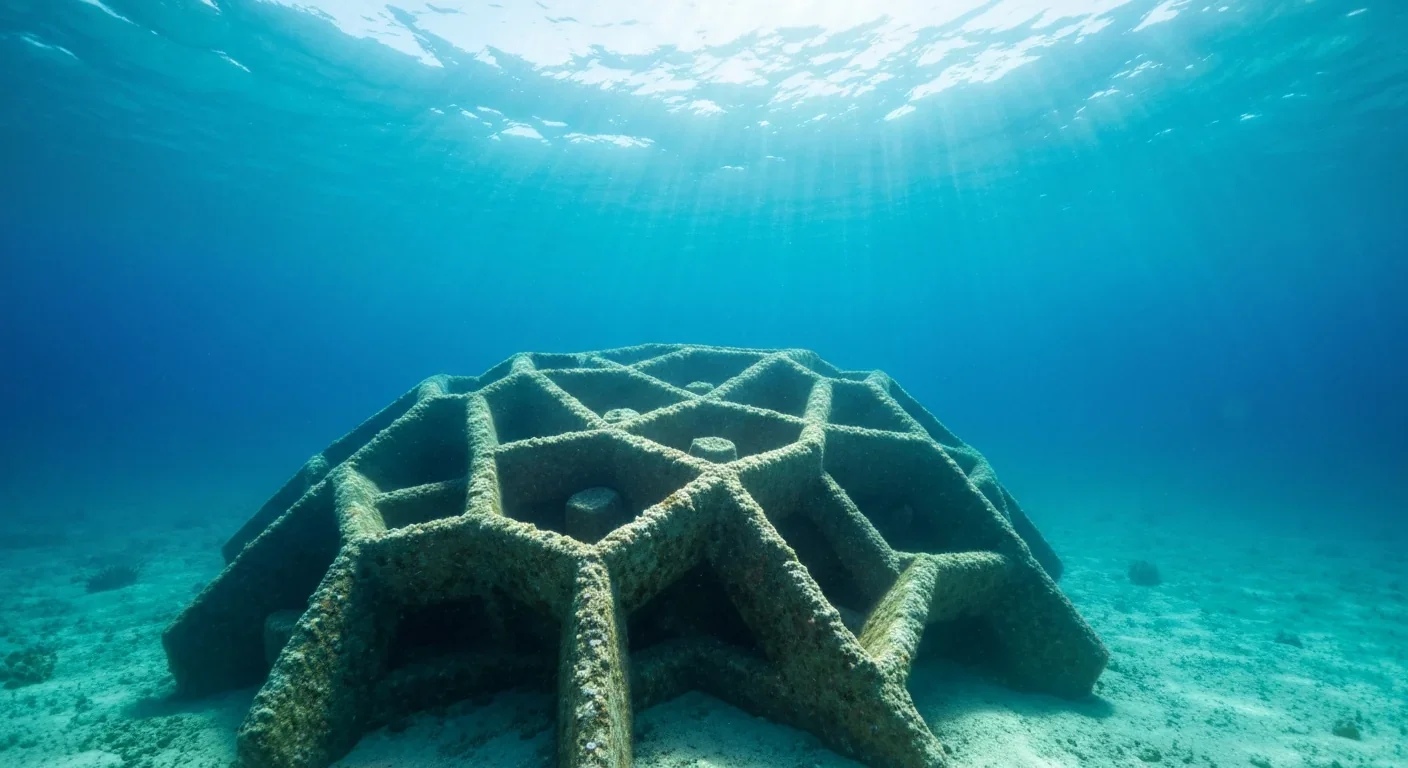

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

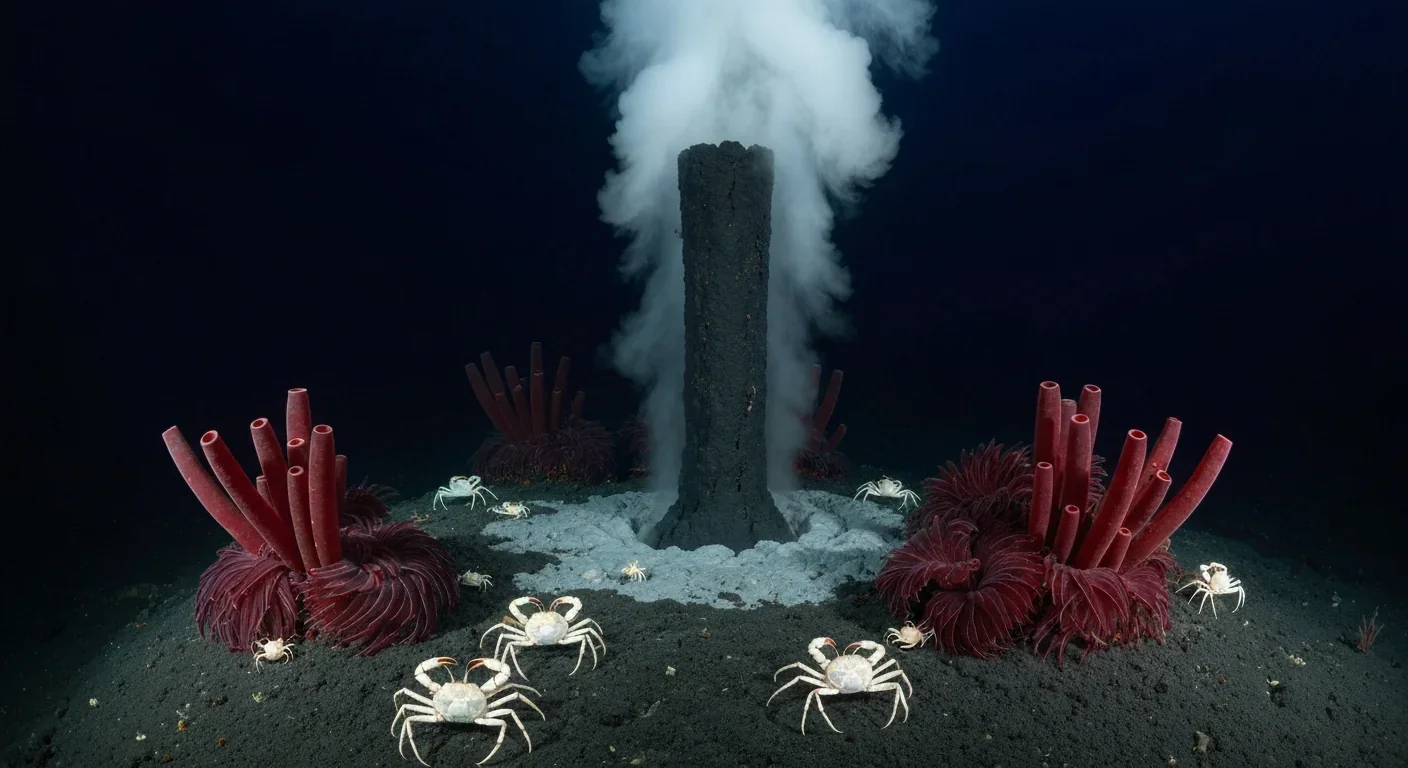

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.