Cache Coherence Protocols: MESI and MOESI Explained

TL;DR: Smart contracts are self-executing blockchain agreements that automate transactions without intermediaries, transforming real estate, insurance, and supply chains. While they offer speed and cost savings, security vulnerabilities and legal uncertainties remain significant challenges.

Picture buying a house where the entire transaction completes itself in minutes. The moment your payment clears, ownership transfers automatically. No middlemen, no delays, no arguing over paperwork. This isn't science fiction. It's happening right now through smart contracts, and they're quietly dismantling the way we've done business for centuries.

A smart contract is an agreement written in code that executes itself when specific conditions are met. Think of it like a vending machine for legal agreements. You put money in, select your option, and the machine automatically delivers what you paid for. No cashier needed, no trust required.

These contracts live on blockchain networks like Ethereum, making them transparent, tamper-proof, and completely autonomous. Traditional contracts require people to enforce them. Smart contracts enforce themselves.

Computer scientist Nick Szabo first proposed the concept in 1994, long before blockchain existed. But it wasn't until Ethereum launched in 2015 that smart contracts became practical, providing infrastructure to run these self-executing agreements at scale.

Before celebrating this technology's promise, we need to talk about The DAO hack of 2016. It's the cautionary tale that still shapes how developers approach smart contracts today.

The DAO was a venture capital fund governed entirely by smart contract code. No executives, no board meetings, just code and community votes. Investors poured in $150 million, making it the largest crowdfunding effort in history at that point.

Then someone found a bug.

The vulnerability was called a reentrancy attack. An attacker drained roughly $60 million worth of Ethereum by repeatedly withdrawing funds before the system could update balances. The response split Ethereum into two separate chains: Ethereum (which reversed the hack) and Ethereum Classic (which didn't).

"One line of unchecked code can cost you millions," security expert Nick Szabo tweeted afterward. That incident forced the entire industry to get serious about security audits and rigorous testing.

Smart contracts create a fascinating problem. They're called "contracts," but are they actually legally enforceable agreements?

Traditional contract law assumes human interpretation. Courts exist because people disagree about what agreements mean. But smart contracts remove interpretation entirely. The code does exactly what it says. If there's a bug, you can't appeal to a judge to fix it.

Wyoming created specific legislation recognizing DAOs as legal entities. The EU's Markets in Crypto-Assets regulation (MiCA) recently came fully into force, establishing frameworks for crypto assets. But enforcement remains tricky. As one observer noted: "You can't sue an algorithm."

The challenge is about what happens when code conflicts with human intent. If a smart contract executes exactly as written but produces an unintended outcome, who's responsible?

Despite legal uncertainties, smart contracts are already transforming real estate transactions.

Traditional real estate deals involve title companies, escrow agents, lawyers, and mountains of paperwork. Each intermediary takes a cut. Average closing costs typically run 2-5% of the purchase price, and the process drags on for weeks.

Smart contracts compress this timeline dramatically. Once conditions are met, ownership transfers automatically. The blockchain becomes the permanent record, eliminating the need for title insurance in many cases.

Studies suggest that 83% of property deals encounter complications using traditional methods. Smart contracts eliminate many common friction points: lost paperwork, delayed signatures, escrow disputes, recording errors.

Propy facilitates international real estate transactions using smart contracts. In 2017, they completed the first blockchain-recorded property sale in the US.

The killer feature isn't just cost savings - it's transparency. Every party can see exactly what conditions must be met for the transaction to complete.

Insurance is becoming one of the most promising applications, particularly parametric insurance where payouts depend on measurable events rather than subjective damage assessments.

Consider flight delay insurance. Traditional claims require filing paperwork, providing proof, waiting for review, and eventually receiving payment weeks or months later. With a smart contract, payout triggers automatically when flight data confirms a qualifying delay.

The parametric insurance market using smart contracts is growing at roughly 10% annually, with projections suggesting it could reach $25 billion. The appeal is obvious: instant payouts, no claims adjusters, no disputes about coverage.

Blockchain technology is revolutionizing insurance claims processing by removing friction, reducing fraud, and cutting administrative costs. Companies like Etherisc offer parametric crop insurance to farmers in developing countries, where traditional insurance is often unavailable.

The limitation is that parametric insurance only works for objectively measurable triggers. But for events with clear data sources - flight delays, natural disasters, market movements - smart contracts excel.

Few people associate Walmart with cutting-edge technology, but the retail giant has become a pioneer in supply chain smart contracts.

Food safety is a massive challenge. When contamination happens, identifying the source quickly prevents widespread illness. But traditional supply chains are opaque. Tracing contaminated lettuce from your local store back to the specific farm can take weeks.

Walmart partnered with IBM to implement blockchain tracking. Now they can trace products in seconds instead of weeks. When contamination occurs, they pinpoint the exact source and remove only affected products.

This isn't theoretical. Walmart has been using this system for years, requiring suppliers of leafy greens to participate. The impact has been substantial: reduced waste, faster response to quality issues, improved consumer confidence.

Blockchain is increasingly being used for supply chain quality assurance, with measurable improvements in traceability and fraud prevention. For industries where provenance matters - pharmaceuticals, luxury goods, organic foods - smart contracts offer verification that paper trails can't match.

The DAO hack wasn't unique. It was the first of many cautionary tales about smart contract security.

Research analyzing Ethereum smart contracts found vulnerabilities in a shocking percentage. Common issues include reentrancy attacks, integer overflows, access control failures, and denial of service vulnerabilities. One study identified 14,891 potentially vulnerable contracts, with more than $6 million in potential losses.

The fundamental challenge is immutability. Once deployed to the blockchain, you can't patch smart contracts like regular software. If there's a bug, the flawed contract exists forever, potentially exploitable.

Ethereum smart contract vulnerabilities can lead to millions in losses. The Parity wallet bug in 2017 accidentally locked $280 million forever. The BEC token incident used an integer overflow to create tokens out of thin air.

Vitalik Buterin emphasized that secure smart contracts need rigorous code review and formal verification. The industry has responded with specialized auditing firms like Cobalt, which identify the top 10 smart contract security risks.

But here's the paradox: the immutability that makes smart contracts trustworthy also makes them dangerous. You don't need to trust a human to enforce the contract, but you absolutely must trust that the code is correct. And code written by humans contains bugs.

Security vulnerabilities aren't the only risk. Smart contracts create new categories of problems.

The oracle problem is particularly thorny. Smart contracts on the blockchain can't directly access external data. They need "oracles" - trusted data sources that feed information into the blockchain. But this reintroduces the trust problem smart contracts were supposed to solve.

Research on external data dependencies reveals that many contracts rely on single points of failure for critical information. If the oracle provides bad data, the contract executes incorrectly. If someone compromises the oracle, they control the contract.

Integrating oracles requires careful design to maintain security and reliability.

Legal challenges in defining and regulating smart contracts remain substantial. Different jurisdictions have different approaches. What happens when a smart contract violates local law? Who bears responsibility?

Consumer protection poses another challenge. Traditional contracts include protections for vulnerable parties. Smart contracts execute automatically, regardless of whether one party was misled or didn't understand the terms.

The conversation around smart contracts is evolving from "code is law" absolutism toward more nuanced hybrid approaches.

Legal experts are developing frameworks that combine smart contract automation with traditional legal safeguards. The Ricardian contract model links machine-readable code with human-readable legal prose.

Courts are beginning to address smart contracts, establishing precedents about enforceability and interpretation. Some jurisdictions treat them as traditional contracts with unusual execution mechanisms.

The technology itself is improving. Formal verification methods can mathematically prove code correctness. Upgradeable contract patterns allow fixes while maintaining security. IBM's blockchain solutions target enterprise clients. The technology is moving from cryptocurrency experiments to serious business infrastructure.

Whether you're a business owner, legal professional, or just someone who signs contracts occasionally, smart contracts will eventually affect you.

For businesses, the calculus is increasingly compelling. Any industry with high transaction costs, slow processing times, or trust issues is ripe for disruption. Supply chains, financial services, real estate, insurance - these sectors are already seeing adoption.

But implementation requires caution. Understanding smart contract risks is crucial before deployment. Budget for professional audits. Plan for edge cases. Have legal counsel review both the code and its implications.

For legal professionals, this technology represents both threat and opportunity. Some intermediary roles will disappear. But smart contract design, audit, dispute resolution, and regulatory compliance create new practice areas.

The skills worth developing? Understanding both code and law. The most valuable professionals can speak both languages.

For the first time in human history, we can create agreements that enforce themselves without requiring trust in any person or institution. That's genuinely revolutionary.

Every previous legal system relied ultimately on human enforcement. Courts, police, social pressure - someone had to make sure agreements were honored. Smart contracts flip this entirely. The code executes no matter what any party wants after the fact.

This creates a fundamentally different kind of social interaction. It's simultaneously more trustworthy (the code will execute as written) and more dangerous (the code will execute as written, even if that produces disaster).

We're still in the early stages of figuring out how this technology fits into human society. The DAO hack happened less than a decade ago. We're learning through expensive mistakes what works and what doesn't.

But the direction is clear. Transaction costs are dropping. Intermediaries are being automated away. Transparency is increasing. And for better or worse, code is becoming an enforceable medium for agreements.

The question isn't whether smart contracts will reshape finance, law, and business. They already are. The question is whether we'll develop them thoughtfully, with appropriate safeguards and legal frameworks, or whether we'll rush ahead and learn through more painful failures.

The technology exists. The use cases are proven. The security challenges are real but manageable. What we do with this capability over the next decade will define how commerce and law function for generations to come.

Welcome to the future. It's already here - it's just not evenly distributed yet.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

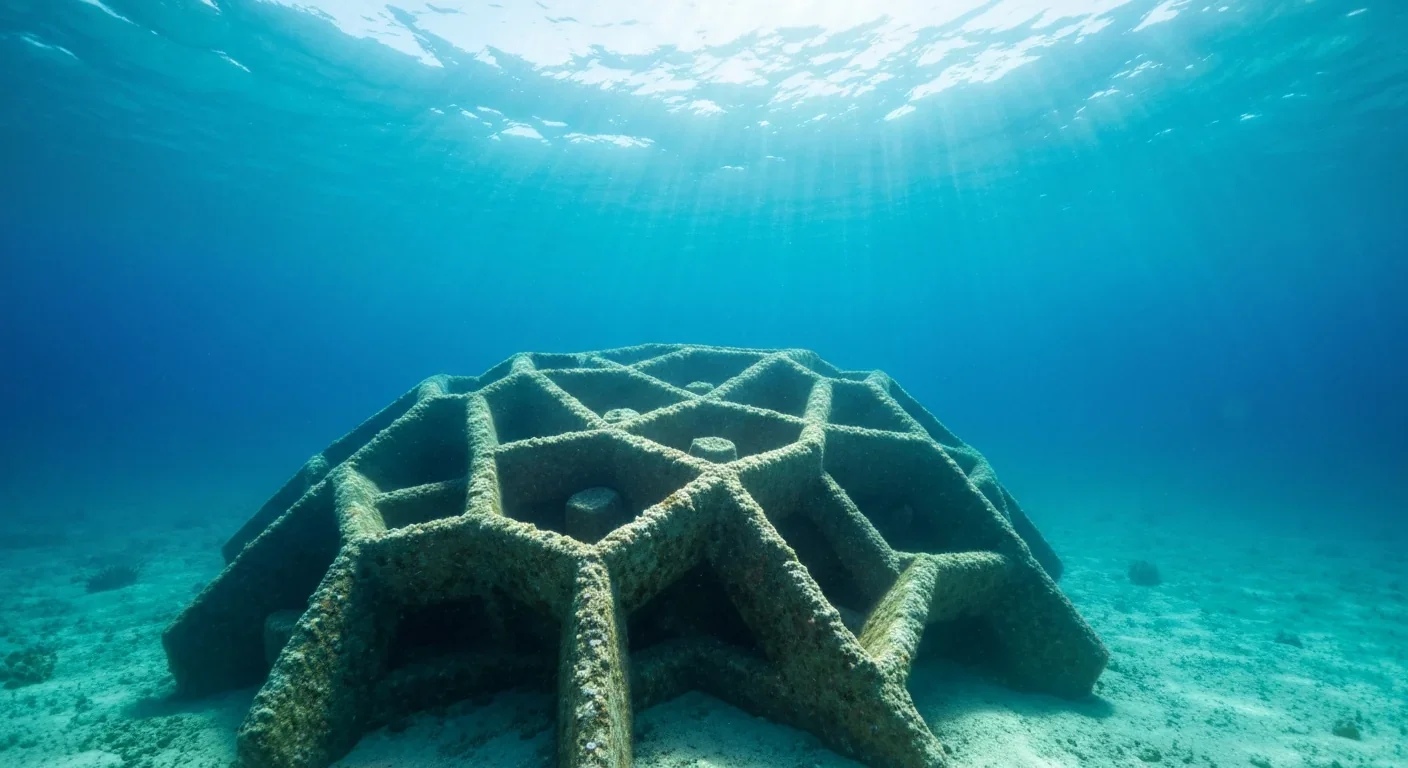

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

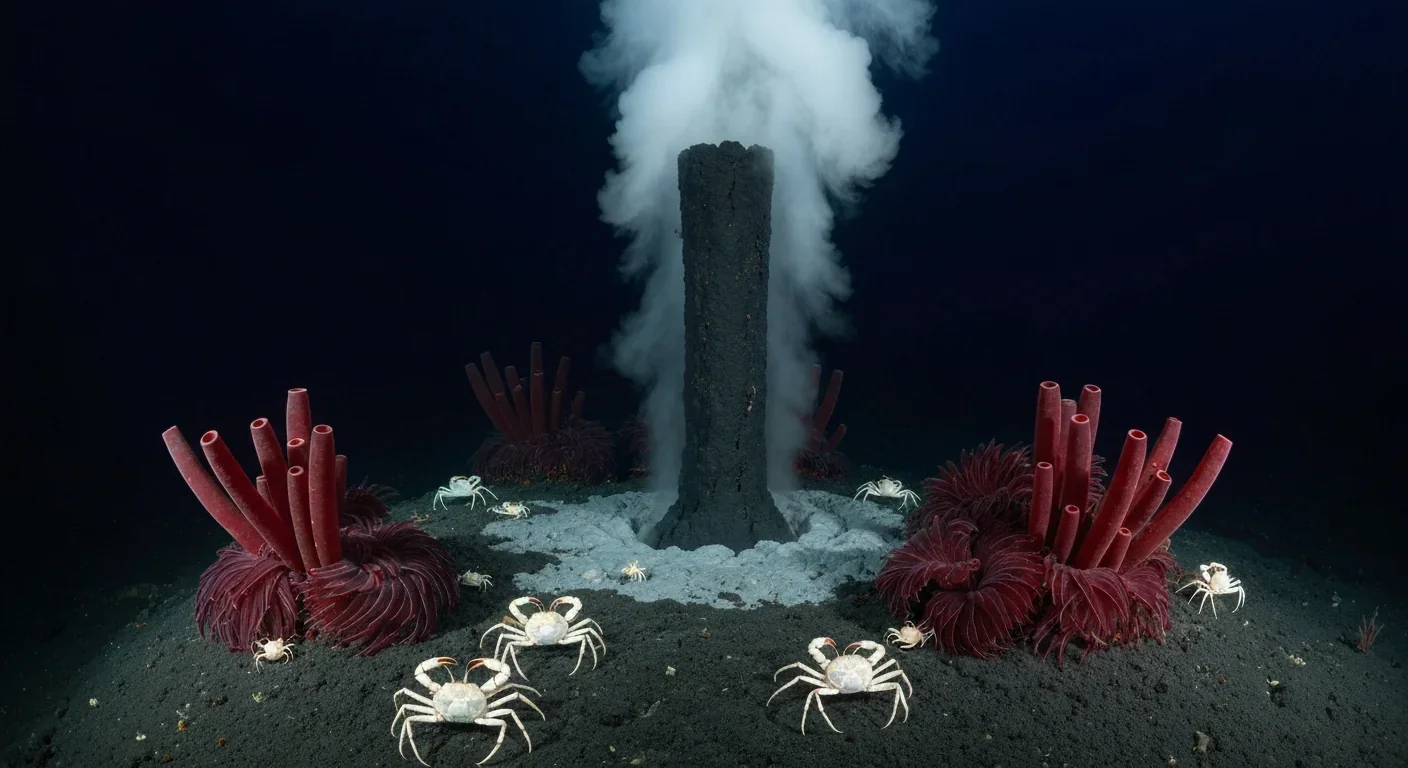

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

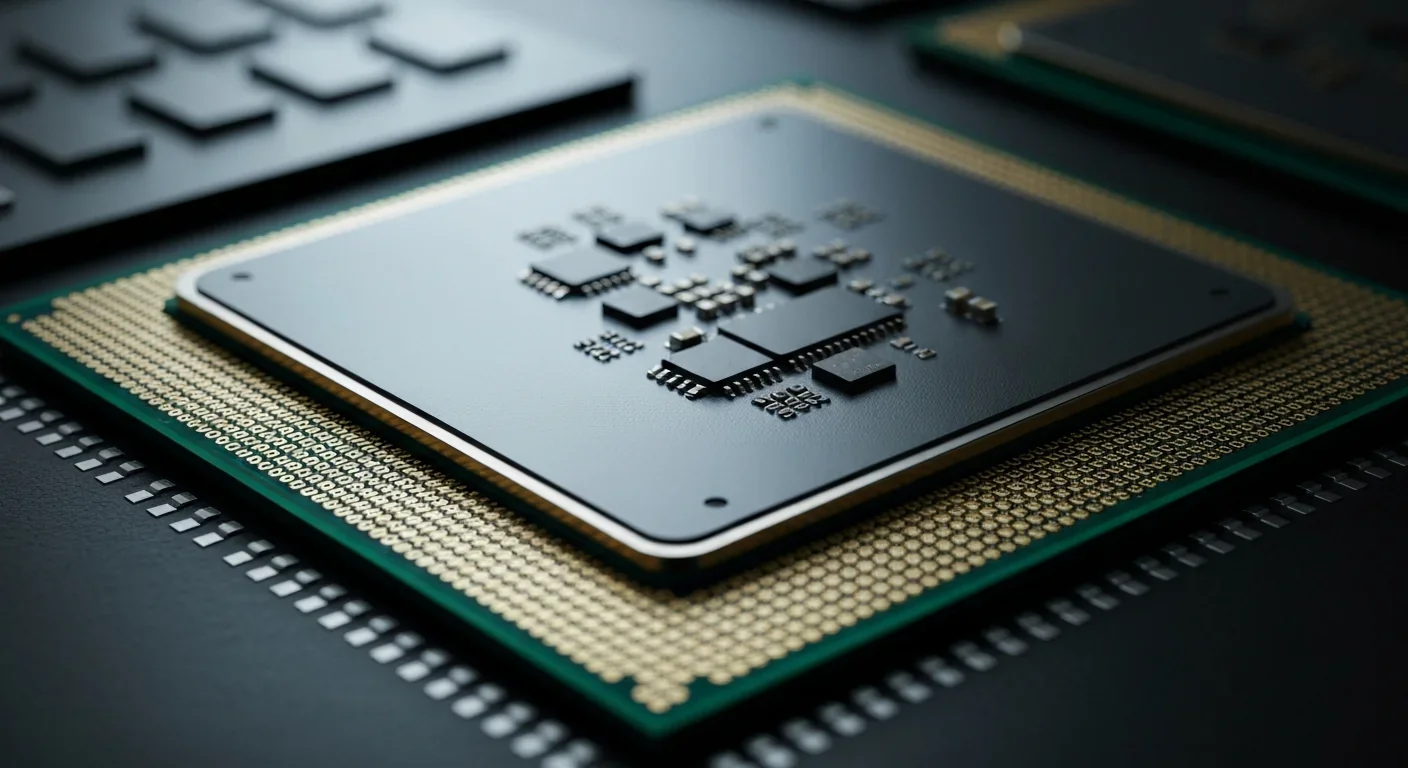

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.