Cache Coherence Protocols: MESI and MOESI Explained

TL;DR: Blockchain consensus mechanisms are transforming supply chains by replacing trust in single authorities with mathematical certainty. Walmart reduced tracing time from 7 days to 2.2 seconds, while luxury brands and pharma companies use immutable ledgers to fight counterfeits and ensure safety.

Imagine shipping a pallet of mangoes from a farm in Mexico to a Walmart store in Dallas. A decade ago, if contamination was suspected, tracing those mangoes back to their origin took seven days of phone calls, paperwork, and manual record-checking. Today, using blockchain technology, Walmart can pinpoint the exact farm in 2.2 seconds. That's not a marginal improvement - it's a fundamental reimagining of how trust and transparency work in global commerce.

This transformation isn't happening because of cryptocurrency hype or speculative investment. It's happening because distributed consensus mechanisms - the mathematical protocols that allow networks of computers to agree on a shared truth without a central authority - are solving real problems that have plagued supply chains for generations: fraud, opacity, inefficiency, and the catastrophic delays that turn food safety incidents into public health crises.

The technology underlying this revolution predates Bitcoin. Byzantine Fault Tolerance, first described in a 1982 research paper, tackled a deceptively simple question: how can a group of generals coordinate an attack when some of them might be traitors? The solution required creating systems where honest participants could reach agreement even when malicious actors were present - exactly the challenge faced by modern supply chains where participants have competing interests and varying levels of trustworthiness.

Fast forward to 2016, when Walmart's food safety team faced a crisis. Foodborne illness outbreaks were making headlines, and the company's existing tracking systems couldn't answer the most basic question quickly enough: where did this contaminated product come from? Traditional databases required trusting a single entity to maintain records. Paper trails relied on human diligence. Neither system could guarantee that records hadn't been altered or that all participants were recording information accurately.

The team turned to Hyperledger Fabric, a blockchain platform using a variant of Practical Byzantine Fault Tolerance. Instead of one company controlling the database, the system distributed trust across multiple participants - farms, processors, distributors, retailers - each maintaining their own copy of the ledger. When mangoes moved through the supply chain, every participant recorded the transaction. The consensus mechanism ensured that all copies of the ledger agreed, and once recorded, the data couldn't be altered without detection.

The results were staggering. Beyond the 2.2-second trace time, Walmart could now track over 25 products from five different suppliers with unprecedented granularity. For pork sold in China - where counterfeit food was a chronic problem - blockchain allowed uploading certificates of authenticity that couldn't be forged. Trust, previously built on reputation and hope, now rested on mathematics.

Supply chain record-keeping has always been about trust. Medieval merchants used wax seals to prove documents hadn't been tampered with. The industrial revolution brought standardized shipping manifests and bills of lading. The digital age introduced centralized databases that traded physical security for speed - but concentrated power in whoever controlled the servers.

Each evolution solved previous problems while creating new vulnerabilities. Wax seals could be counterfeited. Paper records could be lost in fires or floods. Centralized databases became single points of failure, vulnerable to hacking, insider manipulation, or simple technical breakdowns. And fundamentally, every system required trusting someone - the seal-maker, the record-keeper, the database administrator.

Distributed consensus mechanisms break this pattern. Instead of trusting a single authority, they create mathematical frameworks where trust emerges from the protocol itself. Proof of Authority selects a limited number of validators who stake their reputation on honest record-keeping. Practical Byzantine Fault Tolerance requires a supermajority of participants to agree before any transaction is recorded. Hybrid models combine multiple approaches, balancing speed, security, and decentralization.

The printing press democratized information by removing the church's monopoly on books. Distributed ledgers democratize trust by removing any single entity's monopoly on truth.

Understanding how these systems work doesn't require a computer science degree, but it does require rethinking what a database is. Traditional databases are like a master filing cabinet that everyone consults. Blockchain-based systems are like giving everyone their own filing cabinet that magically stays synchronized with everyone else's.

Proof of Authority, commonly used in private supply chain networks, works like a board of directors. Organizations pre-select trusted validators - maybe the top five companies in a supply chain consortium. When a shipment changes hands, these validators verify the transaction based on predefined rules. If a majority agrees the transaction is legitimate, it's added to everyone's ledger. Validators who approve fraudulent transactions can be removed, creating accountability without requiring massive computational power.

Practical Byzantine Fault Tolerance takes a different approach. It assumes some participants might be malicious or compromised. The system requires at least two-thirds of nodes to agree on every transaction. If 30 nodes participate, at least 21 must confirm before anything is recorded. This means the system can tolerate up to one-third of participants being dishonest - a crucial feature when supply chains span countries with different legal systems and enforcement capabilities.

Hybrid consensus models, increasingly popular in enterprise settings, combine multiple mechanisms to balance trade-offs. A pharmaceutical company might use Proof of Authority for speed when recording internal manufacturing steps, then switch to PBFT when products move between companies, ensuring external partners can't dispute records later.

The key insight: these aren't just databases with better encryption. They're systems that make lying mathematically expensive and coordination across distrustful parties economically rational.

The food industry's adoption of blockchain showcases how distributed consensus solves problems traditional technology couldn't. IBM Food Trust, which includes Walmart, Nestlé, and Unilever, now tracks millions of food items globally. When romaine lettuce caused an E. coli outbreak in 2018, stores had to pull all romaine from shelves because they couldn't quickly identify contaminated batches. With blockchain, retailers can isolate specific farms within minutes, protecting public health without destroying safe products.

Pharmaceutical companies face even higher stakes. Counterfeit drugs kill an estimated 250,000 people annually, and serialization regulations require tracking every pill from factory to patient. Blockchain-enhanced pharmaceutical serialization creates immutable records of every custody change, making it nearly impossible to introduce counterfeits without detection.

The system works because every participant - manufacturer, distributor, pharmacy - maintains part of the ledger. A counterfeit drug would need to be added to the blockchain without a legitimate manufacturer's approval, which requires compromising multiple validators simultaneously. This is exponentially harder than, say, bribing a single warehouse worker to swap labels in a traditional system.

Luxury goods face similar problems. Aura Blockchain Consortium, created by LVMH, Prada, and Cartier, uses blockchain to authenticate high-end products. Each item gets a digital certificate tied to its physical production. When a customer buys a handbag, they can verify its entire history - which factory made it, when it was shipped, every authorized dealer who handled it. Resale markets, plagued by sophisticated fakes, can now verify authenticity without relying on the brand's word alone.

BCG estimates that combining blockchain with IoT sensors could reduce counterfeit goods by 50% within a decade, protecting $4.2 trillion in annual legitimate commerce.

The business case for distributed consensus initially seems counterintuitive. Why would competing companies share data on a shared ledger instead of hoarding it for competitive advantage?

The answer lies in what economists call "coordination costs." Supply chains involve dozens or hundreds of entities - farms, manufacturers, logistics companies, customs agencies, retailers. Each maintains separate records. When disputes arise - damaged goods, late deliveries, contamination - reconciling these records costs time and money. A single international shipment can require 200 communications between parties and generate enough paperwork to fill a filing cabinet.

Blockchain doesn't eliminate all these communications, but it dramatically reduces reconciliation time. When everyone shares a single source of truth, there's nothing to reconcile. A shipper and receiver who disagree about when goods were delivered can both check the blockchain, which recorded the exact timestamp when the IoT sensor in the container detected the warehouse geofence. The record can't be altered retroactively by either party.

Studies suggest blockchain could reduce supply chain administrative costs by 15-30% by eliminating duplicate record-keeping and speeding dispute resolution. For industries with thin margins - grocery retail operates on 1-3% profit margins - those savings can be transformative.

There's also a competitive dimension. Companies that can prove their products are authentic, sustainable, or ethically sourced gain customer trust. Consumer research shows 73% of consumers are willing to pay more for products with verified provenance. Blockchain provides that verification without requiring customers to simply trust marketing claims.

For all its promise, distributed consensus isn't a plug-and-play solution. Scaling remains the most persistent challenge. Bitcoin processes about seven transactions per second. Visa processes 65,000. A global food supply chain generates millions of transactions daily. Early blockchain implementations hit speed limits that made them impractical for high-volume operations.

Newer consensus mechanisms address this. Practical Byzantine Fault Tolerance variants can handle thousands of transactions per second by limiting the number of validators and optimizing communication between nodes. Hybrid systems process routine transactions off-chain and only record final states on the blockchain, gaining speed while preserving auditability.

Interoperability poses another hurdle. Most companies already have enterprise resource planning systems, warehouse management software, and customer relationship platforms. Blockchain needs to integrate with these legacy systems, not replace them. That requires middleware that translates between traditional databases and distributed ledgers - adding complexity and potential failure points.

Then there's the human factor. As Frank Yiannas, Walmart's former Vice President of Food Safety, noted: "Let the business lead the project, not the IT department." Technology projects fail when technologists build solutions to problems businesses don't prioritize. Successful blockchain adoption requires identifying genuine pain points - not implementing blockchain because it's trendy.

Regulatory compliance adds another layer. Different countries have conflicting data privacy laws, export controls, and financial regulations. The EU's GDPR includes a "right to be forgotten," which conflicts with blockchain's immutability. Companies operating globally must design systems that comply with the strictest regulations everywhere they operate - or risk massive fines.

Technology adoption creates winners and losers. Large enterprises can afford the upfront investment in blockchain infrastructure, integration with existing systems, and the consultants to navigate implementation. Small suppliers often can't. If Walmart or Nestlé requires suppliers to use blockchain for traceability, small farmers and processors face a choice: invest in technology they can't afford or lose access to major markets.

This isn't hypothetical. Research on agricultural supply chains shows small-scale producers in developing countries struggle to meet blockchain data entry requirements. Many lack reliable internet, smartphones, or the technical literacy to use blockchain interfaces. As large retailers adopt these systems, they may inadvertently consolidate supply chains around larger, better-funded producers.

Some consortiums recognize this risk and design inclusive solutions. IBM Food Trust offers subsidized access for small farmers, and smartphone apps simplify data entry to scanning QR codes instead of manual entry. But charity only goes so far. Long-term solutions require either regulatory mandates that large buyers subsidize small suppliers' technology costs or standardized, open-source platforms that reduce implementation expenses.

There's also a knowledge divide. Supply chain managers trained in traditional logistics may lack the technical background to evaluate blockchain vendors' claims. The technology is new enough that few universities include it in supply chain management curricula. Companies risk buying solutions that don't fit their needs or overpaying for features they won't use.

Different countries approach blockchain adoption differently, creating a patchwork of standards and interoperability challenges. China treats blockchain as a strategic technology and has invested heavily in government-backed supply chain platforms. The country's Belt and Road Initiative incorporates blockchain to track goods moving across Asia, Europe, and Africa, potentially giving Chinese companies a data advantage in understanding global trade flows.

The European Union favors regulatory approaches that ensure data privacy and consumer protection, even if that slows adoption. The EU Blockchain Partnership focuses on creating interoperable standards that allow different national systems to communicate - prioritizing long-term coordination over rapid deployment.

The United States has taken a more market-driven approach, with private consortiums like IBM Food Trust and MediLedger leading adoption. This creates innovation but also fragmentation. A pharmaceutical shipment from Germany to California might cross three different blockchain systems, each with different validators, consensus mechanisms, and data standards. Building bridges between these systems adds cost and complexity.

Emerging economies face unique challenges. Countries with weak institutions see blockchain as a way to create trust despite unreliable governments or corrupt officials. Rwanda uses blockchain to track conflict minerals, ensuring they don't end up in international supply chains. But these nations also lack the technical infrastructure and skilled workforce to implement systems independently, creating dependency on foreign technology providers.

The geopolitical stakes are real. If supply chain data increasingly lives on blockchain networks, whoever controls those networks gains unprecedented visibility into global commerce. A Chinese-controlled platform tracking goods moving through Southeast Asia could provide intelligence that shapes trade negotiations or economic policy. An American platform tracking European pharmaceuticals could raise sovereignty concerns.

International coordination will be essential. Just as the internet required agreements on technical standards like TCP/IP, global blockchain adoption will require agreed-upon protocols for data sharing, dispute resolution, and cross-chain communication.

For companies evaluating blockchain, the first step isn't technical - it's strategic. What problem are you solving? If the answer is "everyone's talking about blockchain," that's a red flag. Successful implementations target specific pain points: reducing counterfeit products, speeding recall responses, proving compliance with regulations, or enabling new business models like verified sustainability claims.

Once you've identified the problem, assess whether blockchain is the best solution. Sometimes it isn't. If you trust all participants in your supply chain and already share data effectively, a traditional database might work fine. Blockchain adds value when participants are distrustful, when no single entity should control records, or when immutability and auditability are critical.

Choosing the right consensus mechanism matters. Proof of Authority works well for consortiums of established companies that value speed and can pre-select validators. PBFT suits scenarios where some participants might be unreliable but you need Byzantine fault tolerance. Hybrid models offer flexibility but add complexity.

Start small. Walmart didn't immediately track all products on blockchain - they started with mangoes and pork in targeted markets. Pilot projects let you test assumptions, refine processes, and demonstrate value before committing to enterprise-wide rollouts. They also give staff time to develop expertise and identify unforeseen challenges.

Integration with existing systems is often harder than the blockchain itself. Your procurement software, inventory management system, and accounting platform all need to communicate with the blockchain. Investing in robust APIs and middleware prevents blockchain from becoming an isolated data silo that creates more problems than it solves.

Partner selection matters too. Are you joining an existing consortium or building a private network? Consortiums offer immediate network effects - suppliers and customers already using the platform - but less control over governance and technical choices. Private networks give you customization but require recruiting participants and achieving critical mass before value materializes.

Finally, prepare for cultural change. Blockchain requires sharing data that companies traditionally hoarded. Procurement teams may resist giving suppliers visibility into demand forecasts. Legal departments may worry about antitrust implications of competitors sharing information. Success requires executive sponsorship that can overcome internal resistance and align incentives across departments.

The next frontier combines blockchain with other emerging technologies. Internet of Things sensors already track temperature, humidity, location, and tampering during shipment. When these sensors write directly to blockchain - without human intermediation - supply chains gain real-time, tamper-proof visibility into conditions at every stage.

Imagine a pharmaceutical shipment that must stay between 2-8°C. IoT sensors monitor temperature continuously and write readings to blockchain every minute. If temperature drifts out of range, smart contracts automatically trigger alerts, reroute shipments to climate-controlled warehouses, or even void insurance coverage if protocols aren't followed. The entire process happens without phone calls, emails, or disputes about what temperature readings really said.

Artificial intelligence adds another layer. Machine learning models can analyze blockchain data to predict disruptions before they happen. If suppliers in a region are reporting unusual delays on blockchain, AI can flag potential problems - a port strike, extreme weather, regulatory changes - and suggest alternatives before your shipment is affected.

Smart contracts could automate payment based on verified delivery. Instead of invoices, approvals, and 60-day payment terms, money transfers automatically when blockchain confirms goods arrived in acceptable condition. This reduces administrative overhead and improves cash flow for suppliers - especially small ones that can't afford to wait months for payment.

The combination creates "autonomous supply chains" that self-monitor, self-optimize, and self-execute. Humans still make strategic decisions - what to produce, where to sell, how to price - but routine operations run with minimal intervention. This isn't science fiction; early implementations already exist in pharmaceutical cold chain logistics and high-value electronics manufacturing.

We're also likely to see new business models emerge. Today, proving your product is organic, fair-trade, or carbon-neutral requires expensive third-party certifications that small producers can't afford. Blockchain-verified supply chains could enable automated certification: if blockchain confirms beans came from specific farms with verified sustainable practices, smart contracts could issue certification automatically and cheaply.

Tokenization of physical goods is another frontier. Imagine fractional ownership of high-value shipments, where investors buy tokens representing shares of a coffee harvest before it's delivered. Blockchain tracks the shipment, and profits distribute automatically when goods sell. This could unlock capital for small producers without traditional bank access.

Within five years, blockchain-verified supply chains will likely be standard for food you buy, medicine you take, and luxury goods you purchase. The change won't be obvious - you probably won't interact with blockchain directly. But the products will carry QR codes that link to blockchain records showing exactly where they came from, when they were made, and every hand they passed through.

For professionals, this creates opportunities and risks. Supply chain managers who understand distributed systems will be invaluable; those who cling to paper and Excel will struggle. New roles are emerging: blockchain architects who design consensus mechanisms for specific industries, data analysts who mine blockchain records for insights, and compliance specialists who navigate the intersection of immutable ledgers and evolving regulations.

For society, the implications are profound. Greater transparency makes fraud harder, which should reduce costs and improve safety. But it also creates surveillance infrastructure. Governments could potentially track citizens through their purchases if supply chain blockchains tie to identity. Activists operating in authoritarian countries could be identified through consumption patterns. Privacy and transparency exist in tension - benefits of one often come at the expense of the other.

The technology itself is neutral. How we govern it determines whether distributed consensus creates a more trustworthy, efficient global economy or a panopticon where every transaction is monitored and nobody can escape their digital past.

The trust revolution is here. The question isn't whether distributed consensus will transform supply chains - it's already happening. The question is whether we'll shape that transformation to serve human flourishing or allow it to optimize for whoever controls the ledgers.

The mangoes at your supermarket might not care. But you should.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

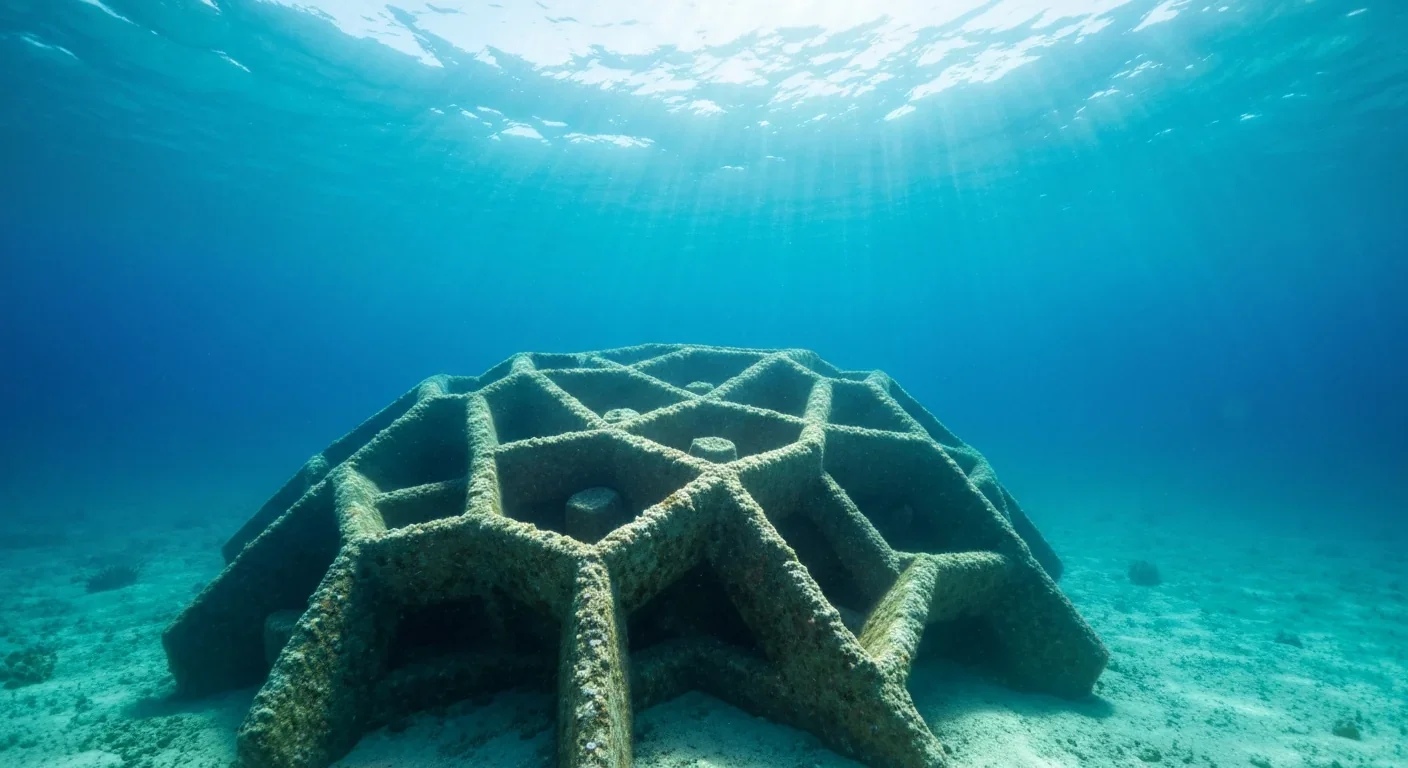

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

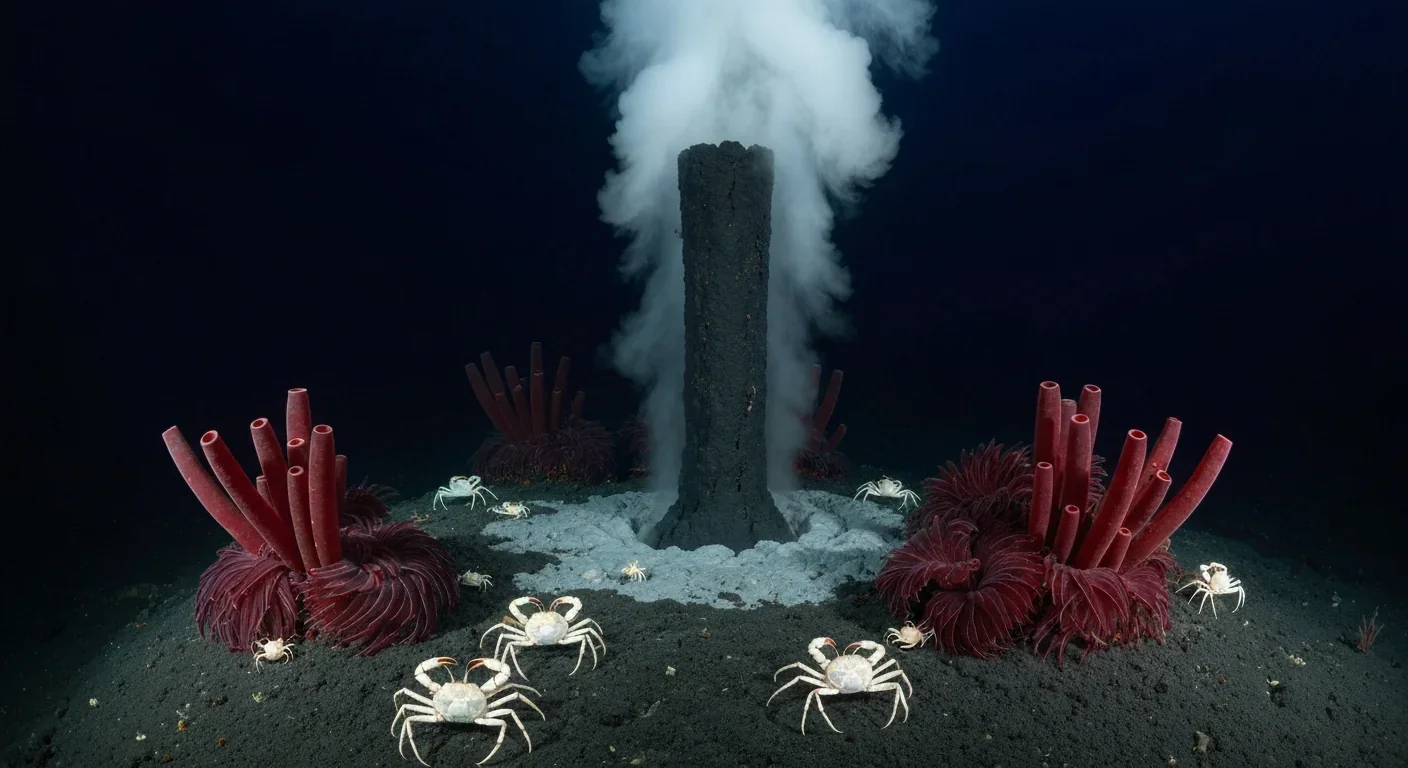

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

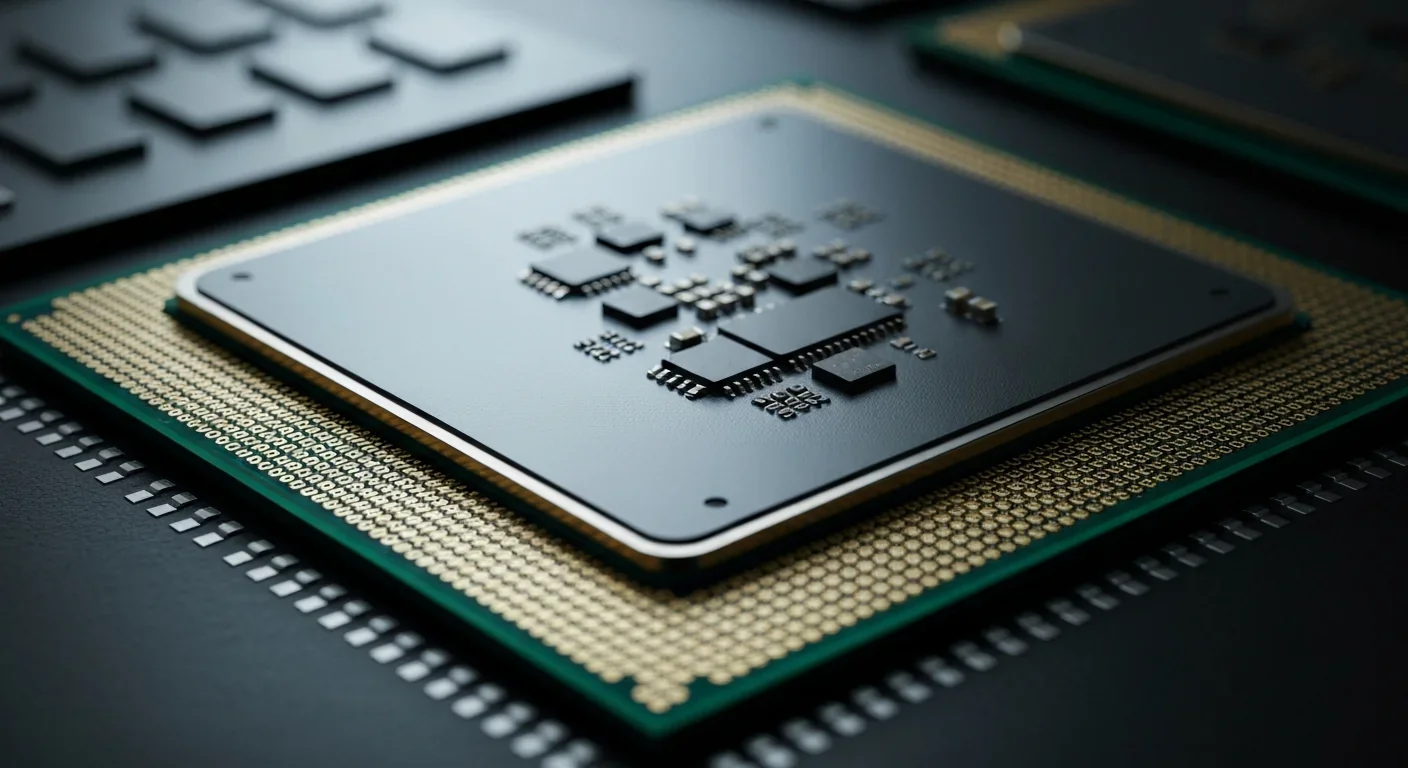

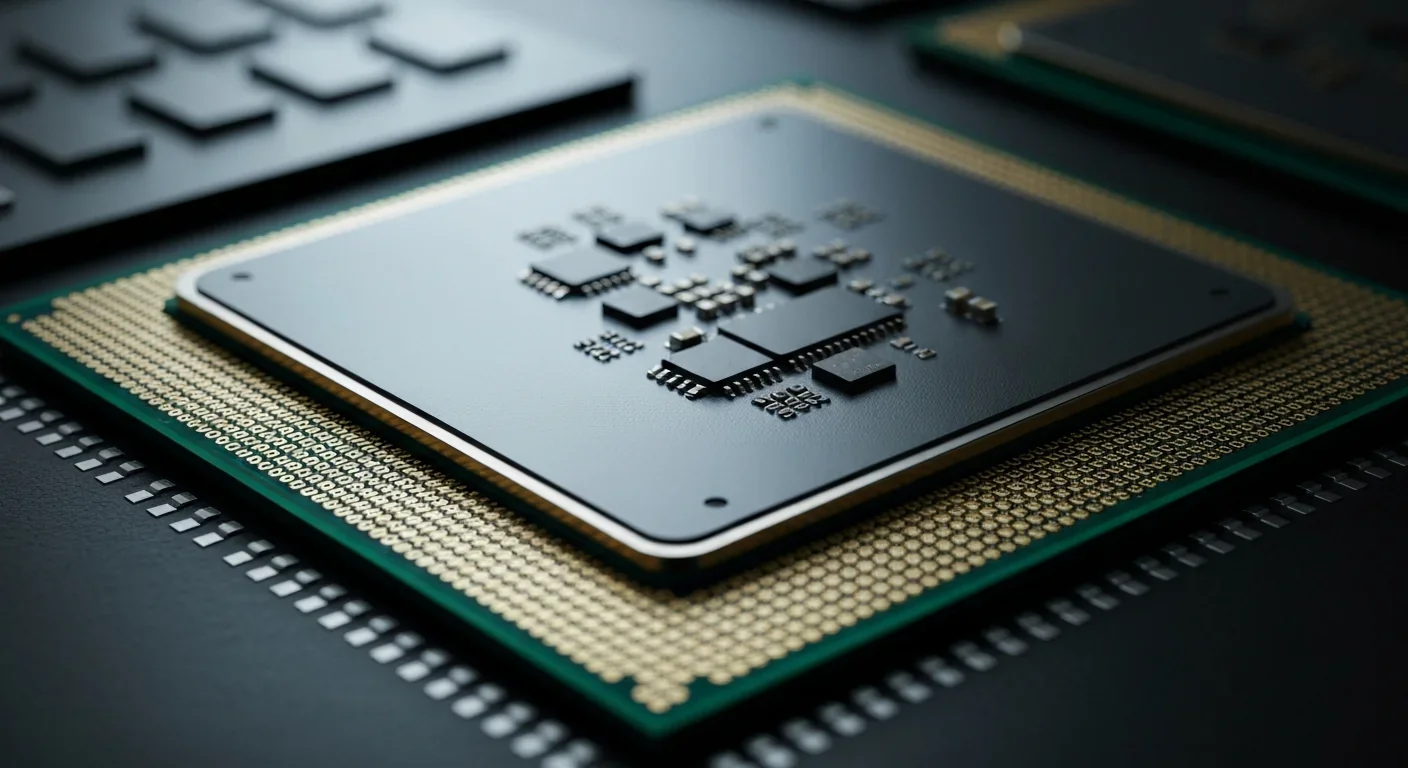

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.