Cache Coherence Protocols: MESI and MOESI Explained

TL;DR: Decentralized identity systems let you own and control your digital credentials through blockchain-verified wallets, eliminating reliance on tech giants and reducing breach risks while enabling instant, privacy-preserving verification across platforms.

Right now, a handful of companies control your digital life. Google knows where you go. Facebook knows who you know. Amazon knows what you buy. Each time you log in with "Continue with Google" or "Sign in with Facebook," you're handing these giants another piece of your identity. But what if you could own your digital self the same way you own your house keys? By 2030, decentralized identity systems could fundamentally reshape how we prove who we are online, putting control back in your hands instead of corporate servers.

Every week brings another data breach. In October 2023, 850 million Indians had their Aadhaar passport numbers leaked onto the dark web. Yahoo. Equifax. Facebook. The pattern repeats because the system is broken at its foundation. We store billions of identities in centralized honeypots, and hackers circle like sharks.

Traditional identity systems work like this: you create an account, the company stores your data on their servers, and you pray they keep it safe. Spoiler alert - they don't always succeed. When a breach happens, you can't just revoke your identity and get a new one. Your email, phone number, and personal details are already floating around the dark web.

Centralized identity systems create single points of failure. One successful attack compromises thousands or millions of accounts. It's the digital equivalent of keeping everyone's valuables in one vault and hoping nobody finds the combination.

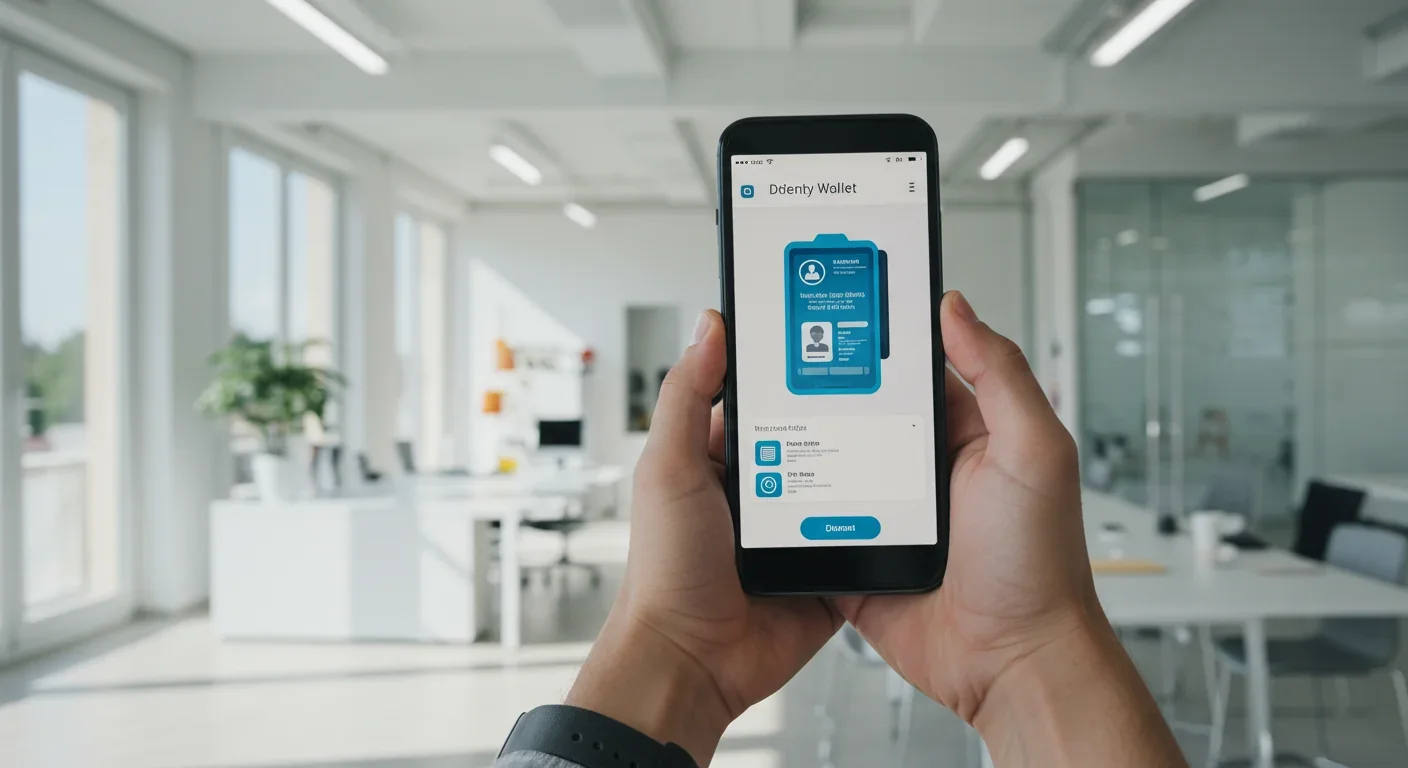

Decentralized identity flips the script completely. Instead of companies holding your data, you carry it yourself in a digital wallet - think of it as a super-secure smartphone app. These systems use blockchain technology not to store your personal information, but to verify it's really yours.

Here's how it works. You get a unique identifier called a DID, short for Decentralized Identifier. This alphanumeric string acts like your digital fingerprint, but here's the clever part: it doesn't contain any personal information. Your actual credentials - driver's license, diploma, medical records - sit in your wallet, encrypted and under your control.

When someone needs to verify your identity, you don't send them your data. Instead, you send cryptographic proof that you possess certain credentials. It's the difference between showing someone your entire wallet versus proving you have a valid ID without actually handing it over.

The technical foundation rests on three pillars. First, distributed ledgers like blockchain provide a tamper-proof record that your DID exists and is valid. Second, verifiable credentials let trusted issuers - governments, universities, employers - stamp your documents with digital signatures. Third, cryptographic key pairs ensure only you can prove ownership of your identity.

When you set up decentralized identity, you generate a pair of cryptographic keys. Your private key stays locked in your device, protected by your biometric data or a strong passphrase. Your public key goes on the blockchain, tied to your DID.

Think of your private key as the world's most sophisticated signature. Nobody can forge it, and you never share it directly. When a bank needs to verify you're really you, your wallet uses your private key to create a digital signature proving ownership - without revealing the key itself.

The W3C standards for DIDs and verifiable credentials ensure interoperability. A credential issued by one system works with another, just like how any bank can verify your passport regardless of which country issued it.

Storage happens in layers. Your public DID lives on the blockchain where anyone can verify it. Your actual credentials stay in your identity wallet, stored locally and encrypted. When you need to prove something, you present just the relevant credential. Applying for an apartment? Share your credit score without exposing your bank statements. Buying alcohol? Prove you're over 21 without showing your exact birthdate.

The shift from centralized to decentralized identity mirrors the historical transition from medieval monopolies to open markets. Just as movable type freed information from monastery scriptoriums, decentralized identity liberates personal data from corporate silos.

Self-sovereign identity means you truly own your digital credentials. No company can unilaterally delete your account or sell your data. No government can easily track your every digital move. The power dynamic fundamentally inverts.

Consider what this means for privacy. Today, creating an account requires handing over your email, phone number, and often much more. The company stores this information indefinitely, uses it for targeted advertising, and might sell it to data brokers. With decentralized identity, you can prove you're a unique human without revealing anything personal. Websites get verification without voyeurism.

The security benefits are equally profound. Distributed systems eliminate single points of failure. If hackers breach one service, they can't access credentials stored in millions of individual wallets.

Decentralized identity isn't theoretical anymore. By 2025, leading networks like ION (built on Bitcoin), the EU's EBSI, and Sovrin are processing real identities for real people.

The Telecom Decentralized Identity Network demonstrates practical implementation. Telecom operators now store device identifiers on blockchain, eliminating redundant registries. Smart contracts automatically validate billing records against service agreements, cutting disputes and manual reconciliation.

European regulations are catching up. The eIDAS 2.0 framework, adopted by the European Parliament in February 2024, mandates that EU citizens receive digital identity wallets by 2026. These wallets will store government-issued credentials, health records, and educational certificates. Traveling within Europe could become as simple as presenting a verified credential from your phone.

Decentralized finance platforms want to verify users without collecting sensitive data. You could prove you're creditworthy without revealing your exact income. You could demonstrate you're not on a sanctions list without disclosing your nationality.

Educational credentials are moving on-chain too. Universities issue diplomas as verifiable credentials, which you store in your wallet forever. No more calling the registrar to verify your degree. Employers can instantly confirm your qualifications through cryptographic verification.

The advantages extend far beyond keeping your data private. Decentralized identity fundamentally changes the economics and power dynamics of digital life.

First, you gain genuine control. Want to delete your data? Just remove credentials from your wallet. No need to submit requests to dozens of companies. Want to port your reputation from one platform to another? Carry your verifiable credentials wherever you go.

Second, verification becomes instant and frictionless. Right now, background checks take days or weeks. With verifiable credentials, employers can confirm your work history in seconds because the credentials come pre-verified by previous employers.

Third, interoperability breaks down walled gardens. Your identity works across platforms because it's based on W3C standards, not proprietary systems. This levels the playing field for smaller services that can't build massive identity infrastructure.

Fourth, decentralized systems align with zero-trust security principles. Rather than trusting users once at login and then assuming continued authenticity, systems can continuously verify credentials.

Decentralized identity faces serious obstacles. Adoption remains low because the technology is new, the user experience is clunky, and the incentives are misaligned.

The biggest barrier is simple inertia. Centralized identity providers have zero reason to support decentralized alternatives. Google and Facebook built trillion-dollar businesses by collecting your data. Why would they voluntarily surrender that advantage?

Key management creates a genuine user experience problem. Lose your password and you can reset it. Lose your private key and you lose your identity permanently. No customer service representative can retrieve it because nobody else has a copy. Solutions like social recovery help somewhat, but they introduce new complexities.

Regulation lags behind technology. Governments want to prevent money laundering and terrorism financing. The US Treasury is exploring requirements for decentralized finance platforms to implement identity verification using digital IDs tied to government credentials or biometrics.

Ecosystem maturity takes time. You need credential issuers willing to sign digital documents. You need verifiers willing to accept them. You need wallet providers building user-friendly apps. Building this infrastructure is like constructing a highway system - it requires coordination across many independent actors.

Different regions approach decentralized identity through different lenses, shaped by their cultural values and political systems.

Europe leads with privacy-first regulation. The eIDAS 2.0 framework treats digital identity as a fundamental right. Every EU citizen will receive a government-backed identity wallet, interoperable across member states.

The United States takes a more market-driven approach. Private companies like Microsoft with its Entra Verified ID system are building decentralized identity solutions anchored on the ION network, which runs on Bitcoin. This creates innovation but also fragmentation.

Indonesia partners with IDCHAIN, integrated with the national domain registry PANDI, to provide self-sovereign identities for citizens. This hybrid model combines government backing with decentralized technology.

Asia broadly sees decentralized identity through an efficiency lens. The focus is less on privacy rights and more on operational benefits. This pragmatic approach might accelerate adoption but could sacrifice some privacy protections.

Whether decentralized identity succeeds depends significantly on what individuals and developers do right now.

For individuals, start experimenting with identity wallets. Apps like Connect.Me, which uses Hyperledger Indy, let you store and manage verifiable credentials today.

Prioritize key management practices. Treat your private keys like nuclear launch codes. Use hardware security modules when possible. Set up social recovery mechanisms. Back up encrypted key stores in multiple secure locations.

For developers, learn the standards. The W3C Decentralized Identifier specification and Verifiable Credentials Data Model are your starting points. Hyperledger Aries provides toolkits for building decentralized identity applications. Hyperledger Indy offers a distributed ledger specifically designed for identity.

Build for interoperability from day one. Don't create yet another proprietary system. Use open standards and contribute to them. The entire value proposition of decentralized identity rests on credentials working across platforms.

Focus intensely on user experience. Most people won't adopt decentralized identity because it's more secure or more private. They'll adopt it if it's more convenient. Can you make key management invisible? Can you make credential sharing feel natural? Solve these problems and you'll have a winning product.

Decentralized identity won't arrive overnight as a sudden revolution. It's more likely to creep in gradually, one use case at a time, until we look back and realize the digital landscape has fundamentally shifted.

The technology exists today. The standards are maturing. Early implementations are processing real identities. What's missing is widespread adoption, which creates a classic chicken-and-egg problem. Users won't switch until there are enough services accepting decentralized credentials. Services won't integrate until there are enough users demanding it.

Breaking this deadlock requires either regulatory mandates, like Europe's eIDAS 2.0, or killer applications that make decentralized identity obviously superior for specific use cases. Financial services, healthcare, and education are prime candidates because they already deal with sensitive credentials that benefit dramatically from cryptographic verification.

The deeper question is philosophical. Do we want a digital future where we own our identities, or one where they're perpetually licensed from tech giants? The former requires active effort and some sacrifice of convenience. The latter is the default path of least resistance.

Decentralized identity offers a genuine alternative to the surveillance capitalism model that dominates today. It suggests that privacy and convenience aren't necessarily incompatible, that security can be distributed rather than centralized, and that individuals can maintain sovereignty over their digital selves.

Whether that vision becomes reality or remains a niche technology for privacy enthusiasts depends on choices being made right now by developers, regulators, and ordinary users. Your digital identity is at stake, and for the first time in internet history, you might actually get to own it.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

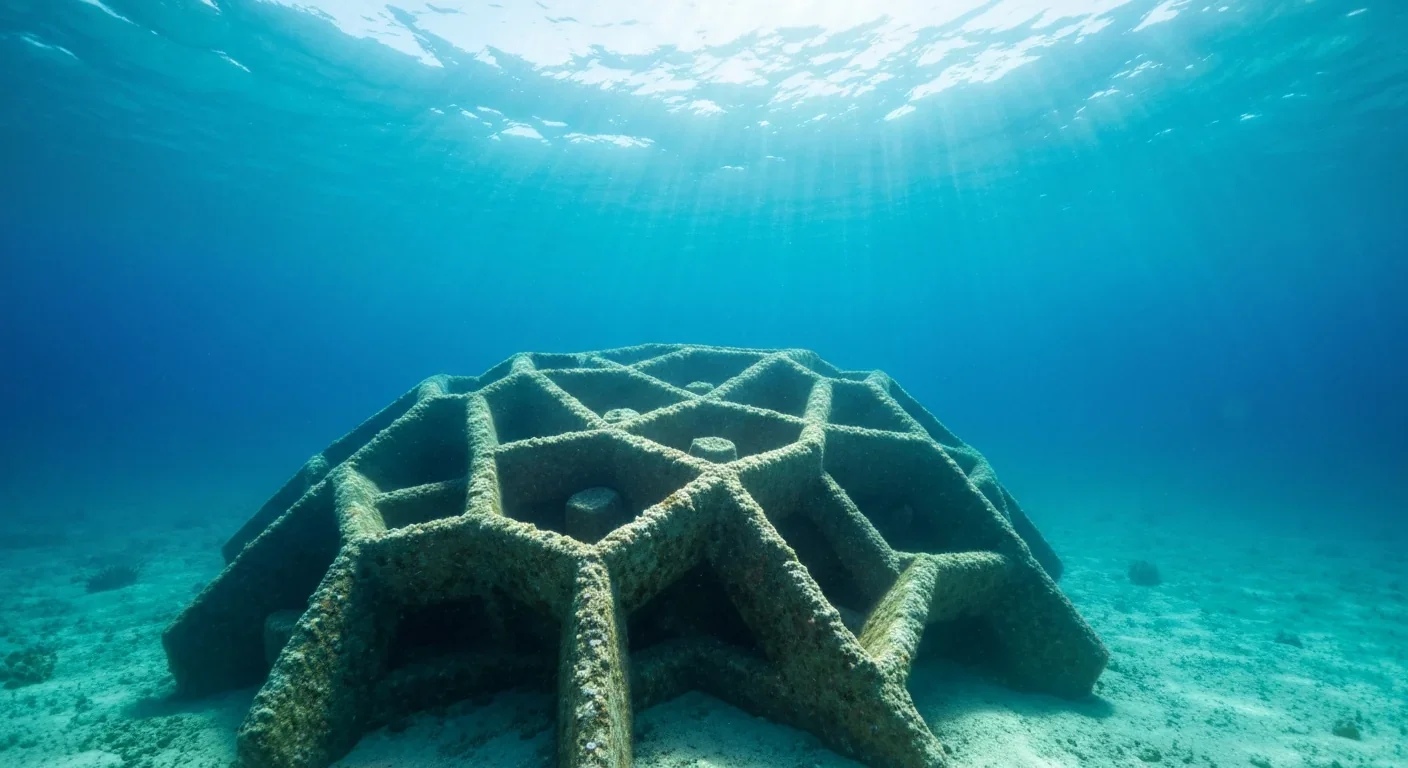

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

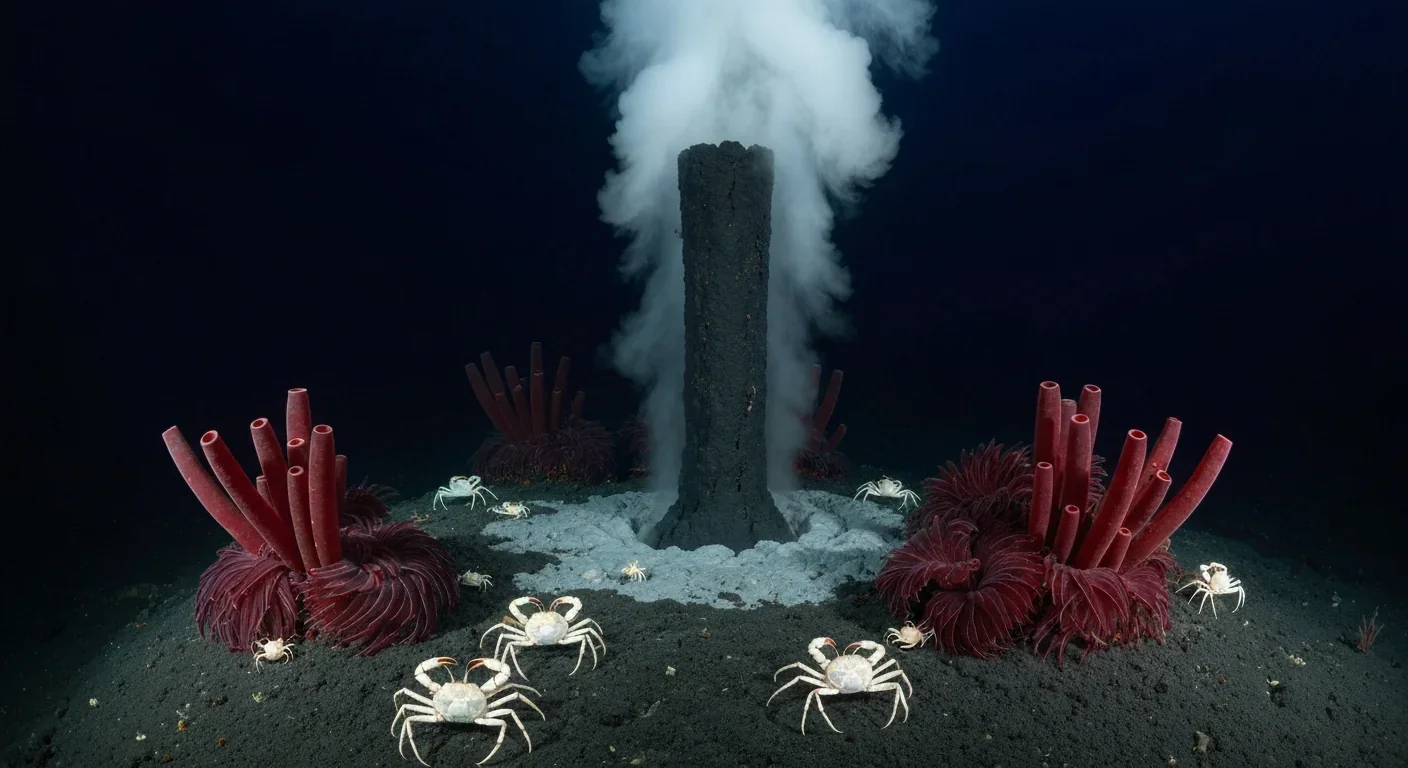

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

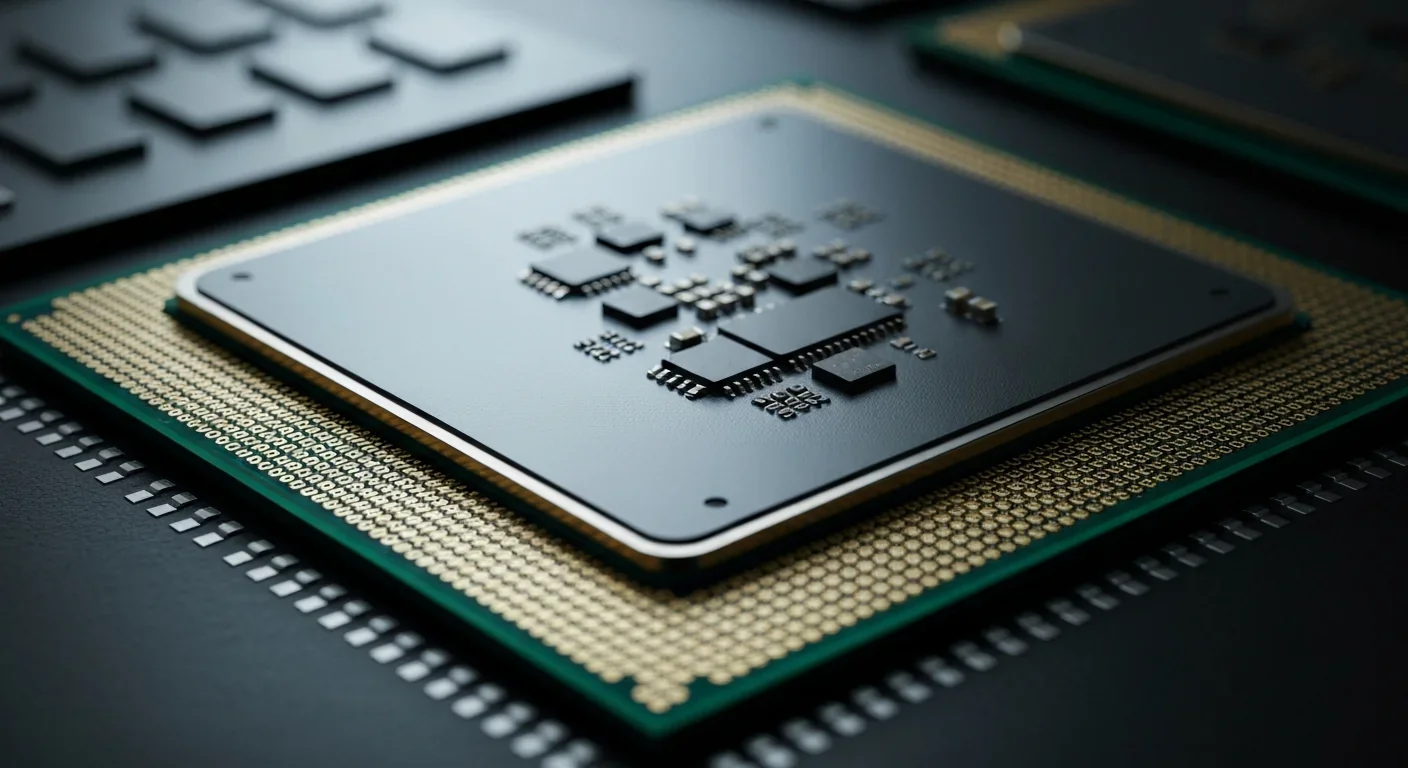

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.